Trader Joe's, Food 4 Less See Visits Increase YoY in California

Retail analytics firm Placer.ai has shared new data detailing the state of the grocery sector in America’s largest state: California.

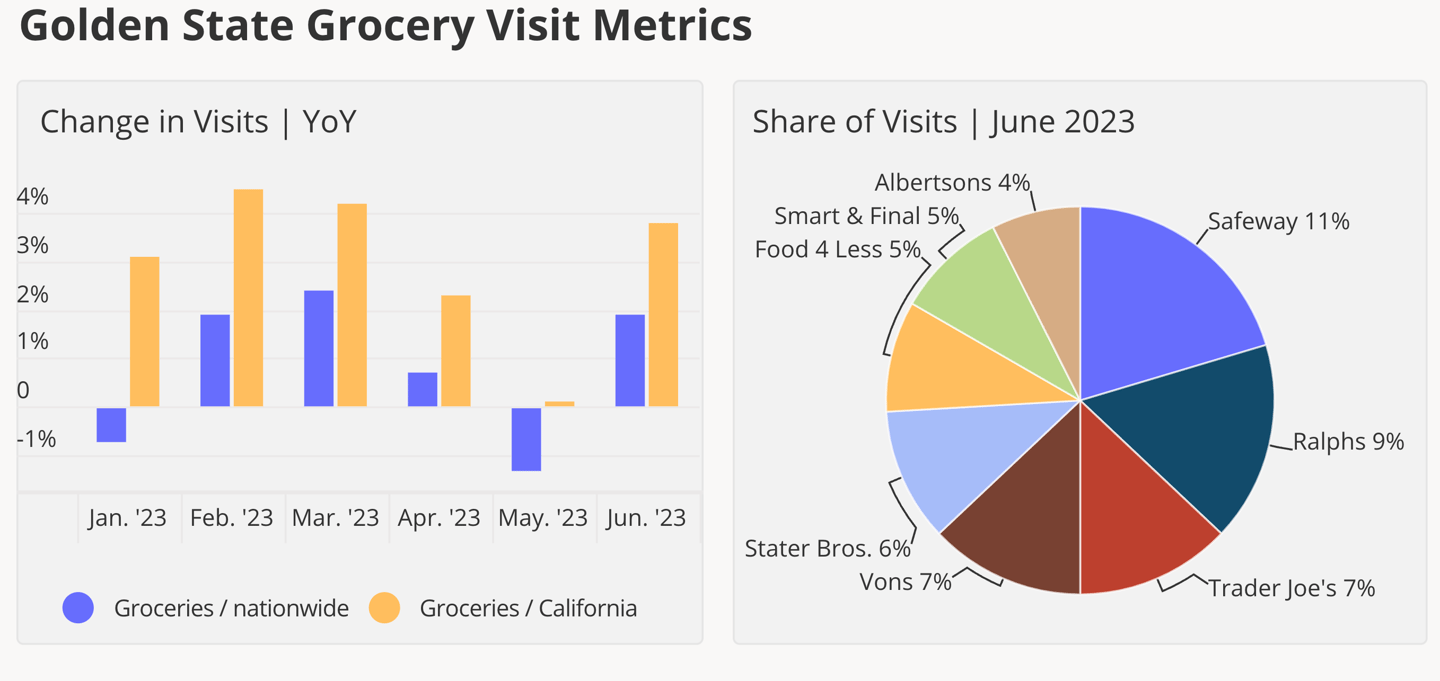

With nearly 40 million residents, Placer.ai describes the Golden State as a “a high-value grocery market due to its robust visitation.” Since January 2023, year-over-year (YoY) grocery visits have consistently outperformed the national average. From January to June of this year, grocery visits in California have increased 3.1%, 4.5%, 4.2%, 2.3%, 0.1% and 3.8% YoY each month while the grocery sector nationwide has its ups-and-downs in terms of traffic.

“Unlike states in other regions, California’s visit share winners lead the pack by a thin margin,” said Ezra Carmel, content writer at Placer.ai, in a blog post. “This is likely to do with the fact that the grocery space in California has some distinctive geographic divisions, with different brands taking the top spot in different regions within the state. But the state’s large population means even a small percentage of total grocery visits has big implications for brands."

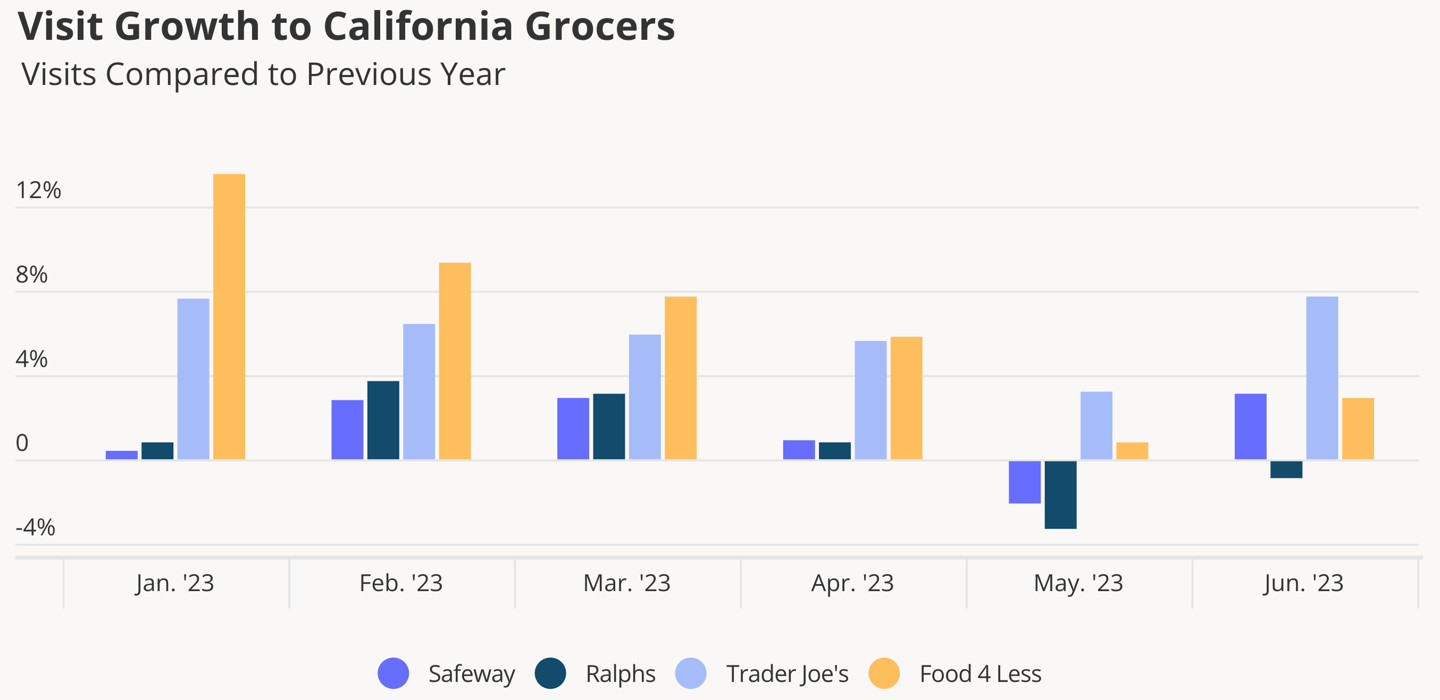

Two grocery chains that have had strong a year so far are Trader Joe’s and Food 4 Less, a Kroger-owned discount banner. While the chain only claimed 5% of the state’s grocery visits share in June 2023, Food 4 Less’ YoY visit growth outperformed the top three chains in the state for the majority of the first half of 2023. The chain’s high-water market in increased traffic came in January, with visits up 13.5% YoY.

Placer.ai previously reported that Trader Joe’s continues to see growth in visits nationwide, fueled by unique private label products, and the same can be said in its home state.

While chains like Safeway and Ralphs take up a greater share of grocery visits, Trader Joe’s has outperformed both in terms of YoY visits. In June, Trader Joe’s saw its largest increase in traffic YoY so far this year, with visits increasing 7.7% compared to June 2022.

Placer.ai found that while both Trader Joe’s and Food 4 Less are succeeding, they are attracting different customers. In H1 2023, the median household income (HHI) of Food 4 Less’ California visitors was 28% below the state average, while the median HHIs of visitors to Trader Joe’s was 23% above. Food 4 Less’ visitors also came from households that were 21% larger than the California average while Trader Joe’s visitors came from households with 11% fewer persons per household than the state average.

“This suggests that Trader Joe’s has benefitted from higher-income consumers that have either been more resilient to the effects of inflation or traded down from premium grocers, while Food 4 Less has capitalized on larger households whose demand for food-at-home means they simply can’t cut back on grocery trips,” wrote Carmel. “Due to the rising cost of eating out, these multi-person households are also likely to be cutting back on restaurant visits – compounding the need for more grocery runs."