Discount Grocer Traffic, Longer Store Visits Farther Apart, Among Placer.ai's Early 2023 Trends

With food inflation remaining high, consumers have shifted their behavior in a number of ways, including but not limited to buying more private label products. As 2023 nears its halfway point, retail data firm Placer.ai has released a new report detailing the five grocery trends that have emerged in the year so far using its latest location analytics.

The white paper, titled 5 Major Grocery Trends Shaping the Industry in 2023, outlines the following takeaways: affordable chains are thriving; immersive grocery experiences are winning; mission-driven shopping is back; small-format grocery stores are on the rise; and retail media networks can help grocers their store fleet beyond growing sales.

“Some (grocery) brands are relying on their attractively priced product mix to find success in spite of – or perhaps because of – rising prices,” wrote Placer.ai. “Other chains are doubling down on convenience by experimenting with smaller formats, while others are finding success by creating immersive shopping experiences. And some are leveraging their physical platforms for additional revenue streams by entering the advertising space.”

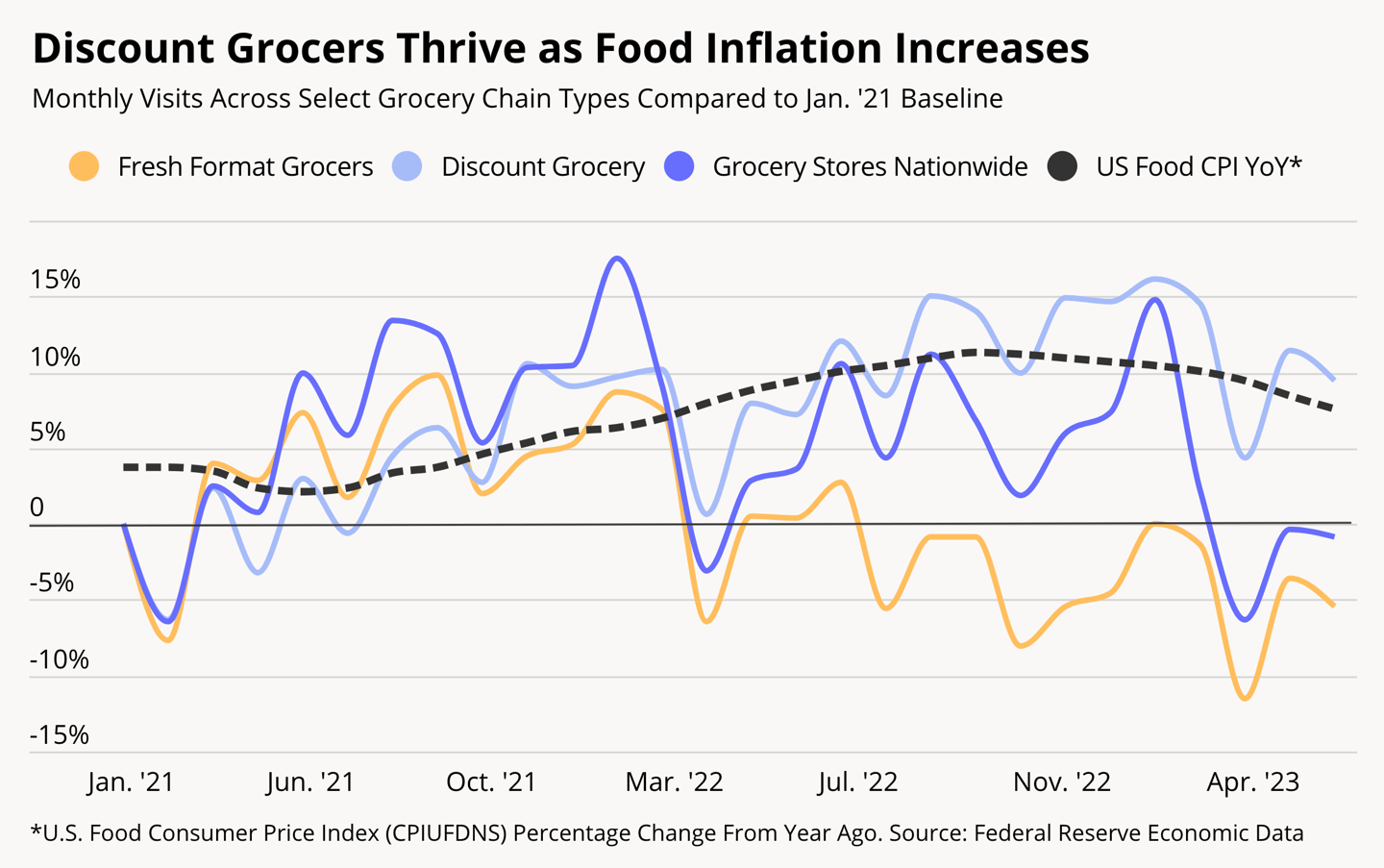

- Affordable Chains are Thriving: High inflation has driven increased foot traffic to lower-cost stores with large private label selections like Aldi and Lidl. According to Placer.ai’s data, traffic to discount grocery chains in April 2023 was up 9.5% compared to the baseline of January 2021. Fresh format chains, including Fresh Market and Natural Grocers, saw decreased traffic of 5.5% in the same period, signaling that consumers are choosing more affordable retailers. Total grocery traffic dipped 0.9%.

- Immersive Grocery Experiences are Winning: H-E-B and Hy-Vee, recently debuted extra-large grocery supercenters, which Placer.ai says turns grocery shopping into an occasion, offering clothing, food courts, pubs, and more alongside groceries. These supersized locations see longer visits and an increase in the share of weekend visits relative to other H-E-B and Hy-Vee locations, suggesting that customers come not just to shop, but to enjoy themselves.

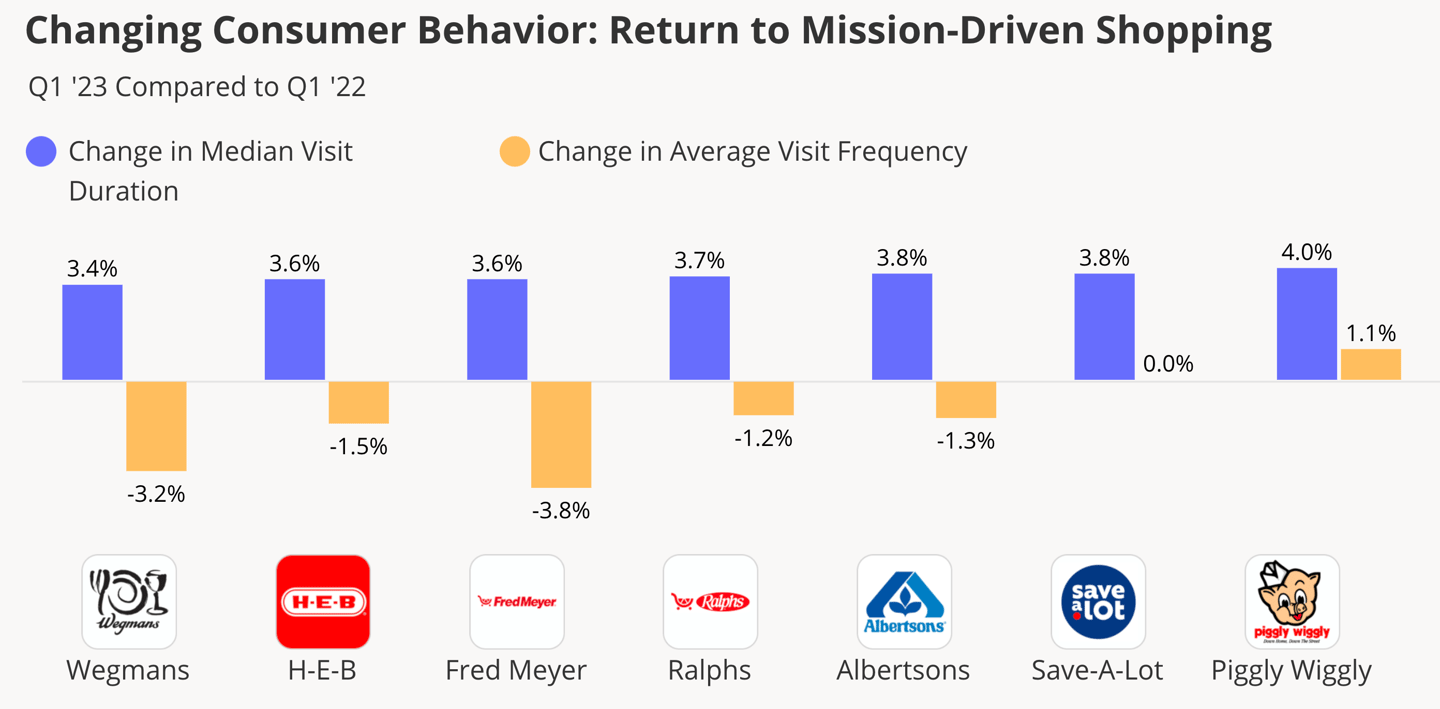

- Mission-Driven Shopping is Back: Like they did during the early days of the COVID-19 pandemic, consumers are being strategic about how, when and where they shop in an effort to reduce spending. Mission-driven shopping is making a comeback, according to Placer.ai’s data. Shoppers are choosing to visit stores less frequently, but are spending longer at the store, suggesting that trips are more planned out to help save money.

- Small-Format Grocery Stores Are on the Rise: Some retailers have recently embraced the small-format store, and grocers like Meijer and Wegmans are seeing success from these types of stores. Wegmans’ smaller-format store receives more visits per square foot than nearby locations, while Meijer’s small-format store is seeing a higher-income. For example, Wegmans’ small format store in Wilmington, Del. is around 40% smaller than the average Wegmans in the Philadelphia area, but receives more visits per square foot than any store in the metro area. In Michigan, foot traffic data from February to April of 2023 shows that the trade areas for the two new Meijer Grocery locations attracted a customer base from a trade area with a higher-than-average median household income.

- Retail Media Networks Can Help Grocers Leverage Their Store Fleet Beyond Grocery Sales: Grocery chains can use location intelligence to build in-store retail media networks that identify where key demographics live, shop, and what their preferences are. As of Q1 2023, 22% of all grocery visits in the United States went to grocery chains that operate retail media networks, a number Placer.ai expects to grow.

The full white paper can be found here.