Placer.ai: Discount, Dollar Store Visits Steady, Superstore Visits Decrease in Q1 2023

Retail data firm Placer.ai has released its Quarterly Index for Q1 2023, highlighting slower but steady discount & dollar store traffic and decreased superstore visits to start the year.

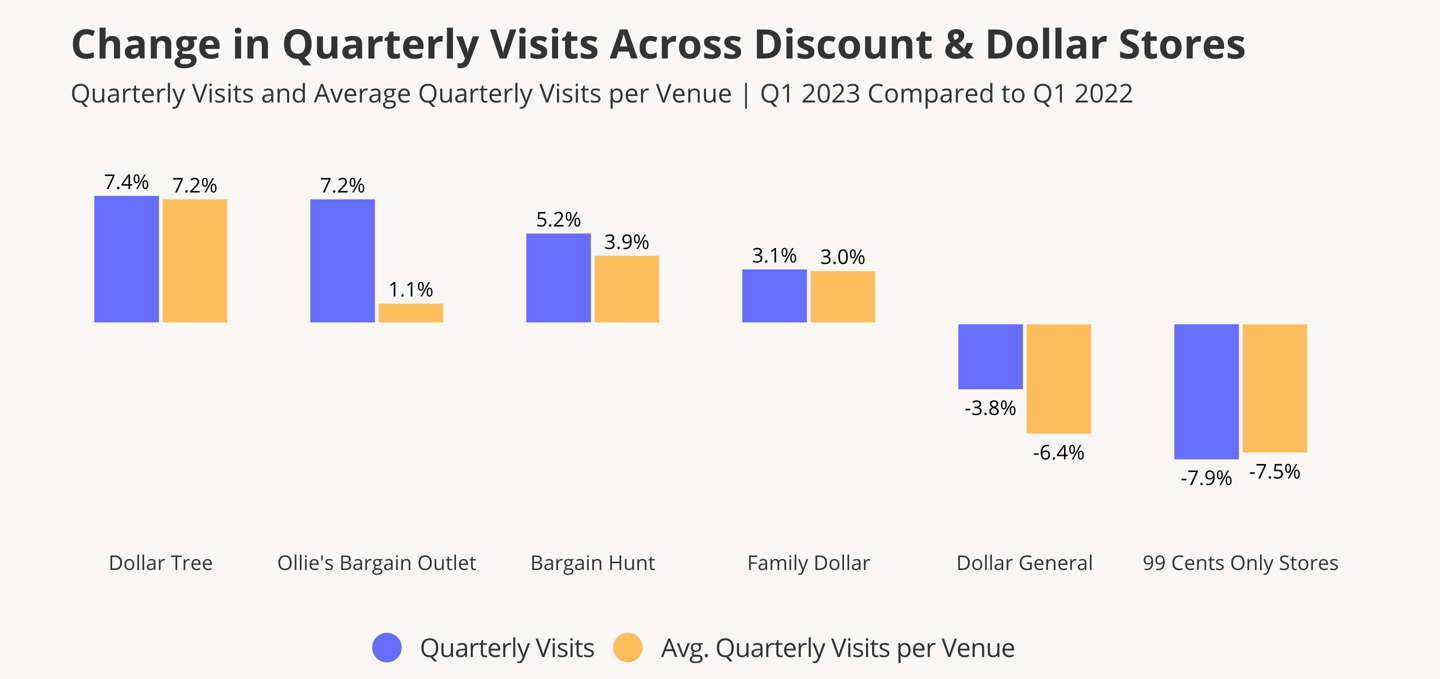

Dollar chains saw rapid gains following the onset of COVID-19, but in the latest quarter, that growth is beginning to slow down, with March traffic remaining close to 2022 levels. Dollar Tree saw the largest jump in year-over-year visits in Q1 2023 (+7.4%), followed by Ollie’s Bargain Outlet (+7.2%), Bargain Hunt (+5.2%) and Family Dollar (+3.1%). Dollar General (-3.8%) and 99 Cents Only Stores (-7.9%) saw visits decrease.

Of the discount & dollar chains, Dollar Tree (37.9%), Dollar General (35.5%) and Family Dollar (13.9%) made up the vast majority of visits.

“The sector’s success in maintaining its pandemic-era visit gains despite the volatile economic environment indicates that discount & dollar stores are now embedded in many consumers’ regular shopping routine,” said Placer.ai in the report.

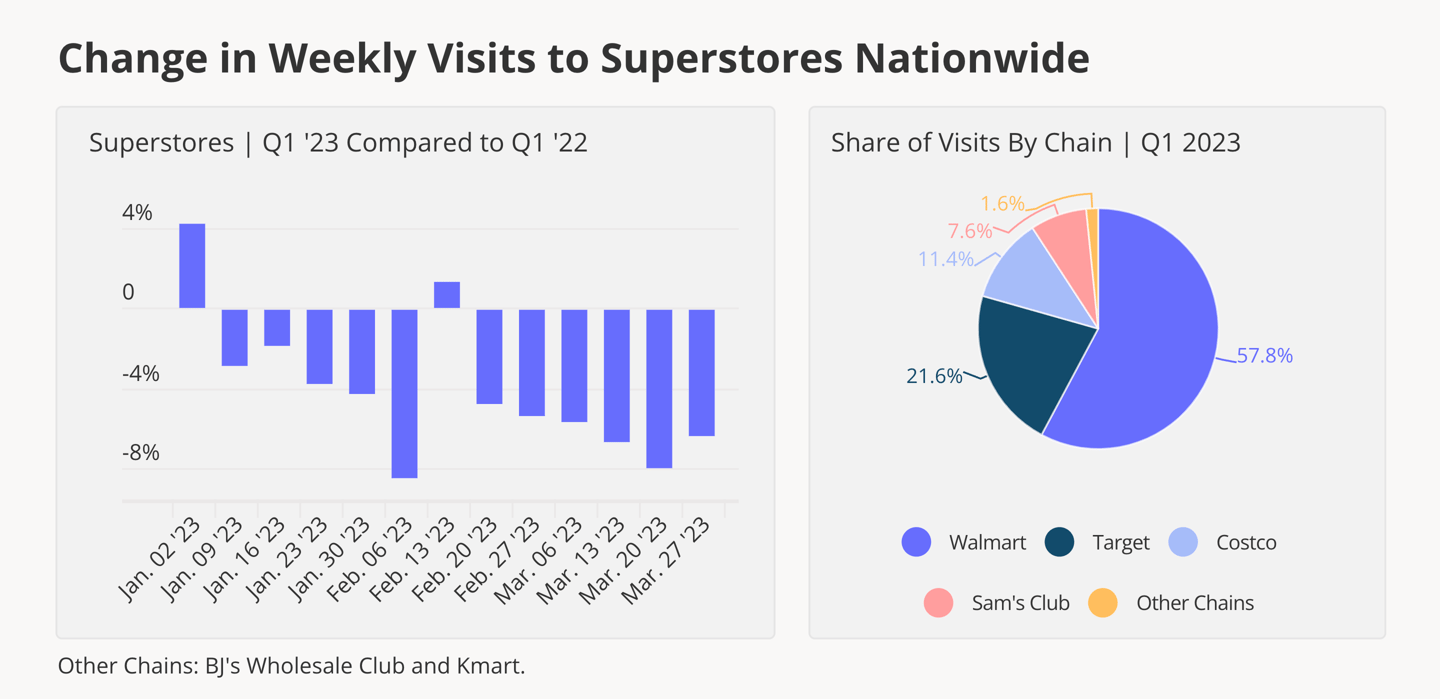

For the superstore sector, Target was the only retailer to see increased visits year-over-year (+1.5%). Walmart (-5.3%), Sam’s Club (-5.4%), Costco (-5.9%) and BJ’s Wholesale Club (-6.7%) all saw decreased visits compared to Q1 2022. Placer.ai said that the decreases are due to consumers limiting trips in an effort to save money, Target has been able to thrive in part due to its private brands.

“Still, Target – the second largest superstore chain – saw its visits and visits per venue grow relative to Q1 2022,” said Placer.ai. “The chain’s success could be partially due to its appeal to younger shoppers, its expanding portfolio of brand partnerships and shops-in-shop and its assorted private labels appealing to a variety of customers.”