Trader Joe's Sees Visits Increase, Outpacing Grocery Overall

Fueled by unique private label items at affordable prices, Trader Joe’s has seen visits increase in recent months while outpacing the grocery category as a whole, according to new data from Placer.ai.

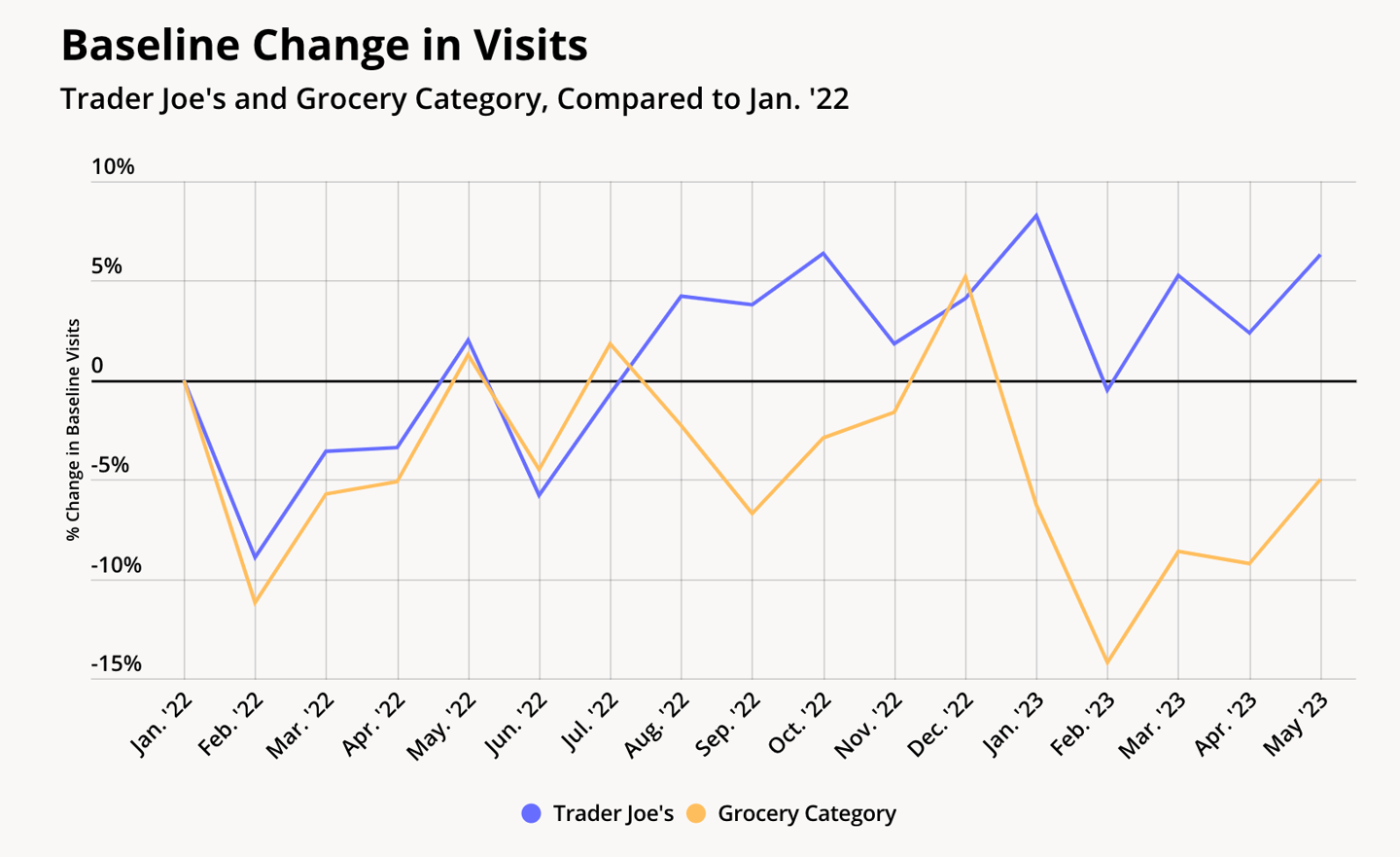

Last month, Trader Joe’s saw visits increase 6.3% compared to January of 2022. Total grocery visits were down 5.0% during the same period. The retailer saw visits increase more than 5% compared to January ‘22 in October of last year (6.4%), and January (8.2%) and March (5.3%) of this year.

“Comparing visits to Trader Joe’s and to the wider grocery category to a January 2022 baseline highlights the company’s strength: Between January and July 2022, Trader Joe’s foot traffic trends mostly mirrored those of the wider food industry,” wrote Placer.ai’s Ezra Carmel in a recent blog post. “But since August 2022, the baseline change in visits to Trader Joe’s has remained mostly positive, while traffic to the overall grocery category slumped. By May 2023, visits to Trader Joe’s were 6.3% higher than in January 2022, while visits to the grocery category as a whole declined by 5.0% during the same period."

With consumers continuing to search for more value, Trader Joe’s wide selection of unique and differentiated private label products are attracting shoppers. In the most recent Axios Harris Poll 100 of America’s most visible and trusted companies, Trader Joe’s ranked fourth among the most-trusted companies in the United States.

"Trader Joe's has a uniquely powerful draw that enables visit strength even during periods where formats more oriented to a wider product range should have an advantage,” Ethan Chernofsky, SVP of Marketing at Placer.ai, told Store Brands. “The most reasonable conclusion is that the retailer's focus on service and orientation towards beloved products helps incentivize visits that a more focused format would otherwise struggle to obtain."

In the recent blog post, Placer.ai compared Trader Joe’s traffic to Ralphs traffic in Los Angeles, Calif., where both retailers have a comparable trade area. Trader Joe's visits per square foot were more than three times higher than Ralphs’ visits per square foot, a testament to the specialty retailer’s growth.

However, during Q1 2023 the Ralphs locations had a higher percentage of repeat visitors who visited at least three times (32.4%) than did the Trader Joe’s location (24.9%). Private brands are continuing to see gains at Kroger’s banner stores, as the retailer reported a 4.9% increase in revenue for its private label products during its fiscal year first quarter.

“So despite the Trader Joe’s location’s higher visits per square foot and larger trade area, a higher percentage of visitors visited Ralphs repeatedly – a conventional grocery store – during the analyzed period,” added Carmel. “This suggests that while Trader Joe’s specialty nature is an attractive proposition, demand for conventional grocers remains strong.”