Placer.ai: Dollar Stores Continue to Thrive, Grocery and Superstores See Slight Upswing in Q2

Data firm Placer.ai has shared its latest Q2 2023 Quarterly Index, which highlighted retail trends such as a continued increase in discount & dollar store visits, minor improvements for the grocery channel and a shaky quarter for the superstore sector.

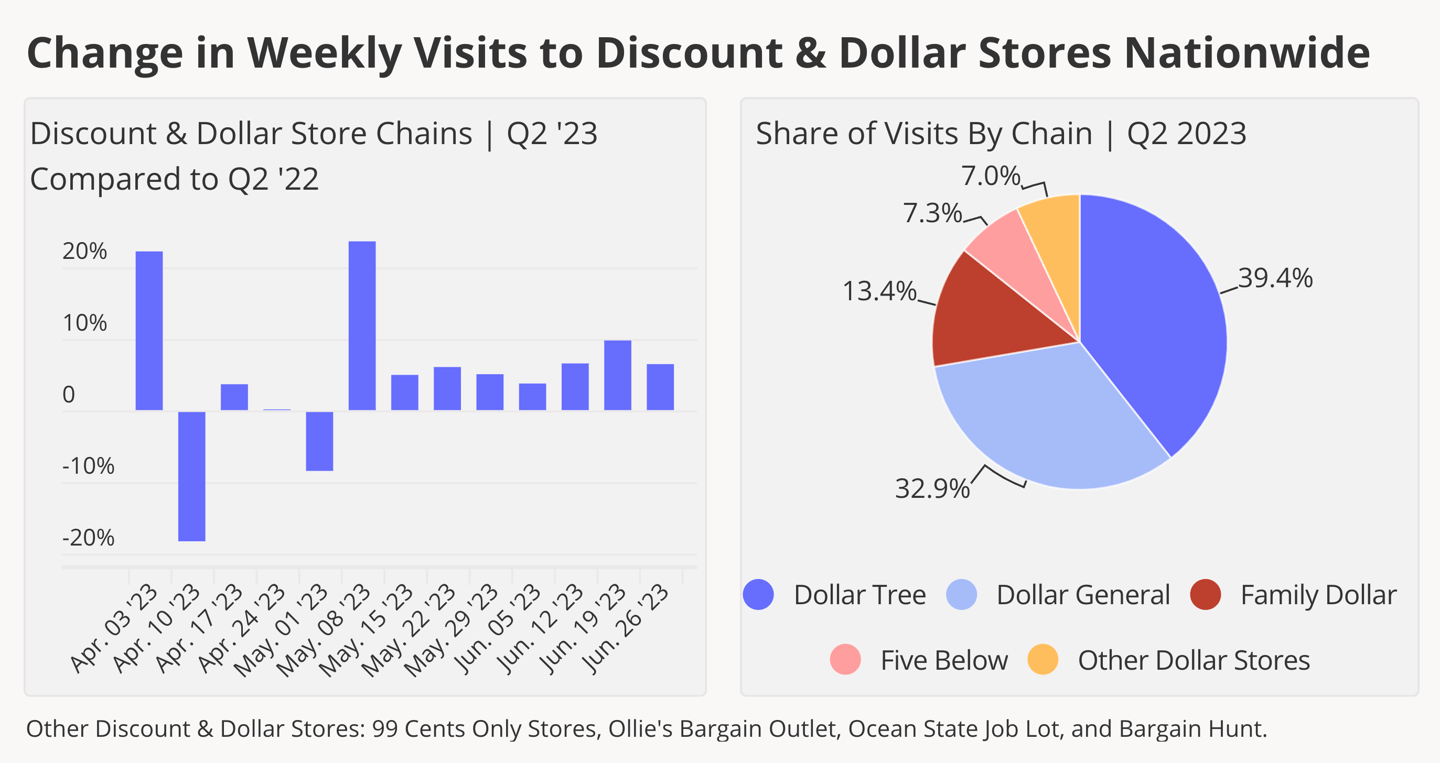

Discount & dollar stores continued to see increased visits after a strong Q1. Weekly visits to the category were up almost every week of the quarter, with year-over-year (YoY) weekly foot traffic up by 3.7% to 9.7% since mid-May. Dollar Tree (39.4%) and Dollar General (32.9%) lead the channel in visit share, followed by Family Dollar (13.4%). While Dollar General is America’s largest retailer by store count, Dollar Tree and its Family Dollar chain saw visits increase 10.5% and 5.1%, respectively YoY.

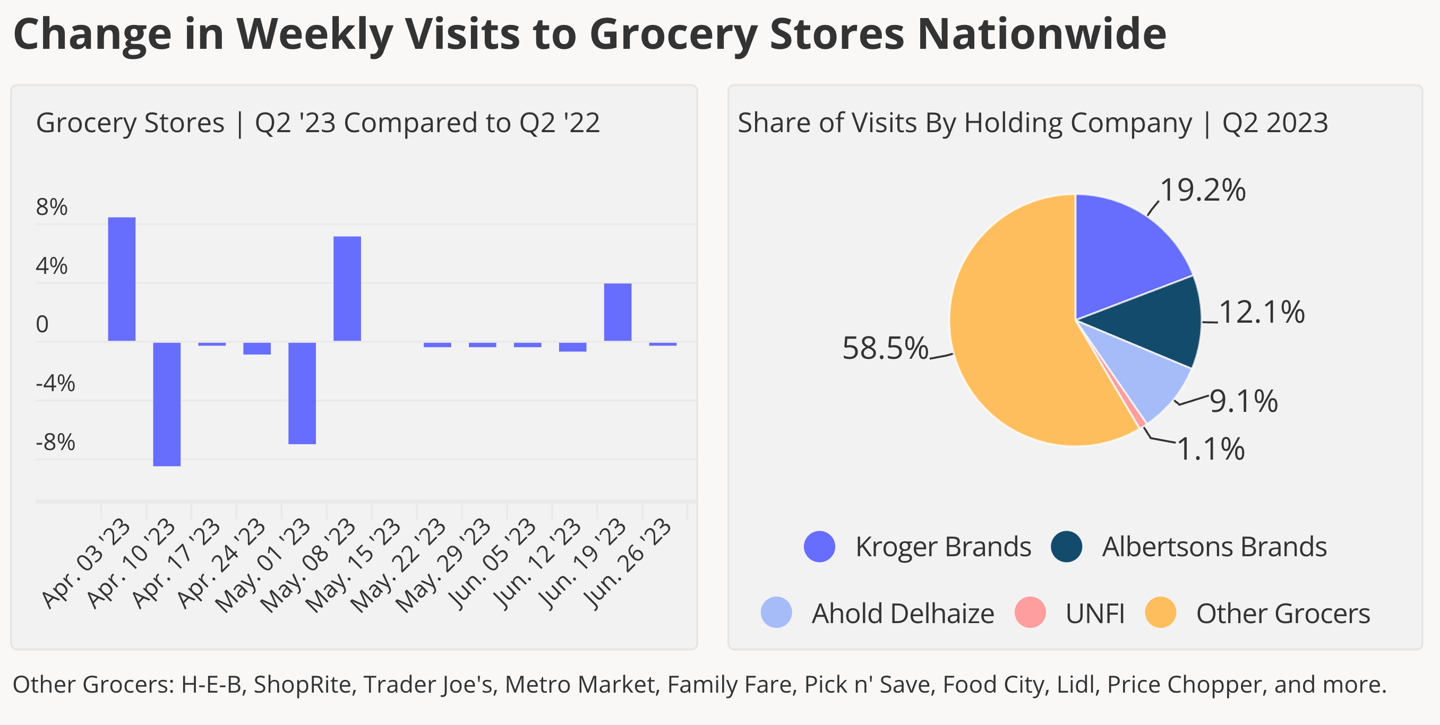

During most of Q2, visits to grocery stores were slightly beyond the YoY comp. However, since the week of May 8, grocery foot traffic has remained on par or exceeded last year’s traffic levels. Trader Joe’s (9.7%), WinCo Foods (5.5%) and Aldi (5.4%) saw the greatest increases in quarterly visits YoY, while ShopRite and H-E-B saw gains as well. Meijer (-2.3%) and Kroger (-4.9%) saw decreases in YoY traffic during the quarter.

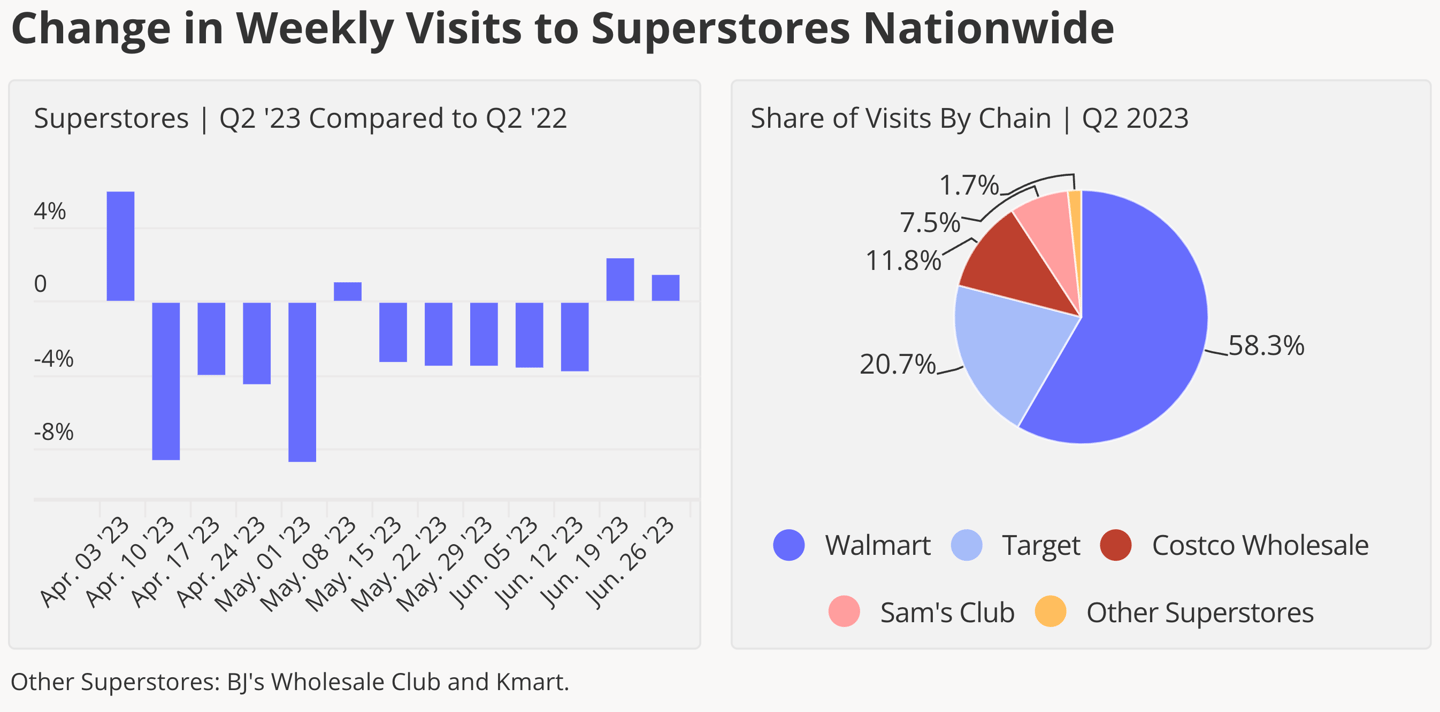

In the superstores category, which includes club retailers, foot traffic is appearing to rebound after a slow quarter. Since mid-May, the YoY weekly visit gaps remained below 4.0%, and the last two weeks of Q2 even saw YoY visit trends swing positive. Costco saw YoY visits increase 0.7%, while Sam’s Club (-0.3%), Walmart (-2.8%), Target (-2.8%) and BJ’s Wholesale Club (-4.2%) saw YoY visits decrease in Q2. Walmart continues to lead the category in visit share, making up for nearly 60% of visits to superstores in Q2.

The full Q2 2023 Quarterly Index can be found here.