Placer.ai: Target, Costco See First-Half Visits Increase YoY

Superstores serve tens of millions of Americans everyday who rely on the sector for groceries, as well as home goods, outdoor items, apparel and more.

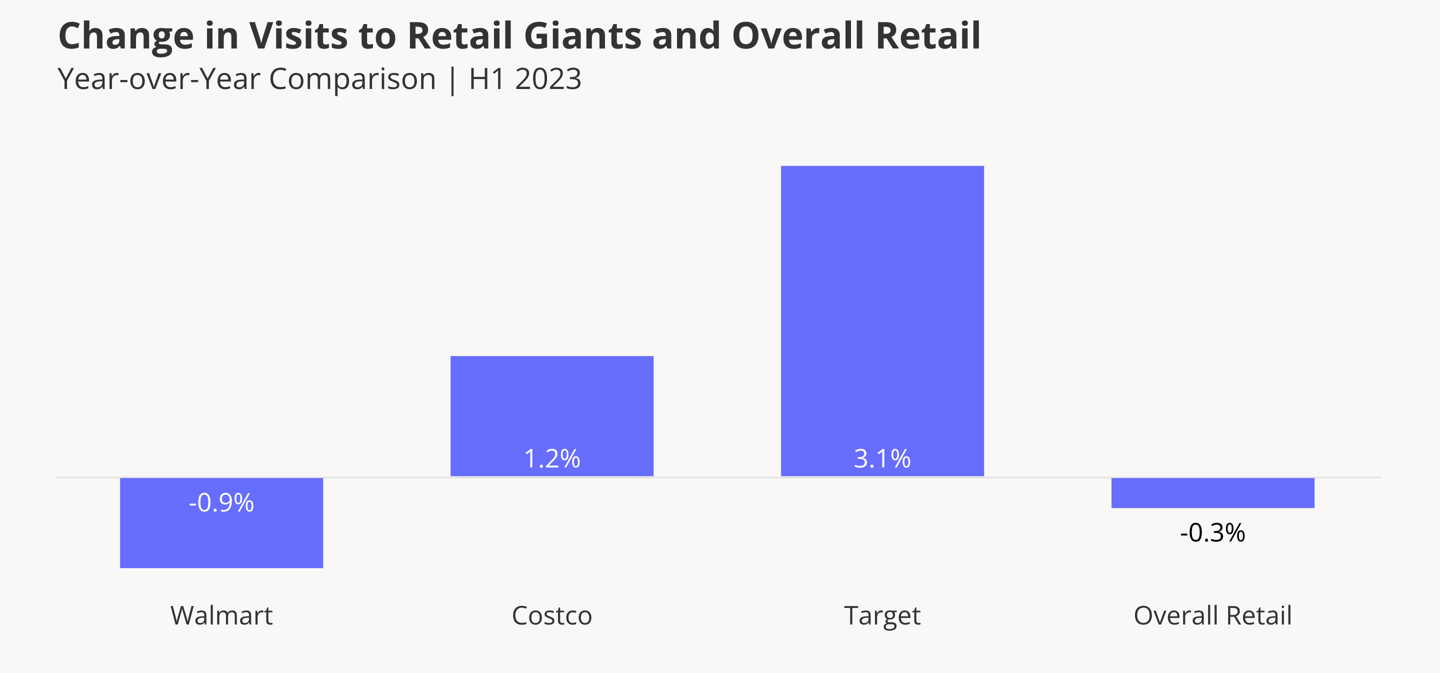

In the first half of 2023, Costco and Target saw visits grow year-over-year (YoY), while Walmart saw slippage, according to a new white paper from Placer.ai titled Retail Giants in 2023: Visit Patterns to Walmart, Costco and Target. In the first six months of 2023, Costco and Target outperformed the wider retail sector on a YoY basis, posting visit growth of 1.2% and 3.1%, respectively, compared to a 0.3% dip for overall retail. Walmart saw its visits decreased by 0.9% YoY.

Between H1 2019 and H1 2023, Walmart’s visit share of total retail visits shrunk from 55.2% to 50.6%, while Costco’s and Target’s grew from 9.8% to 10.3% and from 16.8% to 18.7%, respectively. The share of visits to the Discount & Dollar Store category also increased from 18.2% 20.4%, showing that despite its massive store count and low prices, other retailers are becoming more competitive with Walmart.

R.J. Hottovy, head of Analytical Research at Placer.ai, told Store Brands that unique private label assortments could explain Target and Costco’s strong performance in the first half of the year.

"As consumers have become more focused on value, we've seen a definitive consumer shift toward private label and store brand offerings, especially in dry grocery and processed foods,” said Hottovy. “However, our visitation data also suggests that those retailers are investing in innovations around their private label assortment--including more products across a wider number of categories, ‘better-for-you’ ingredients, and more diverse flavor profiles, and are seeing greater visits on a relative basis. We've seen it in the grocery category with some of the innovations with Aldi's and Trader Joe's private label assortment, but we're also seeing some evidence that new products from Target's grocery private labels, including Favorite Day and Good & Gather, have helped to drive visits."

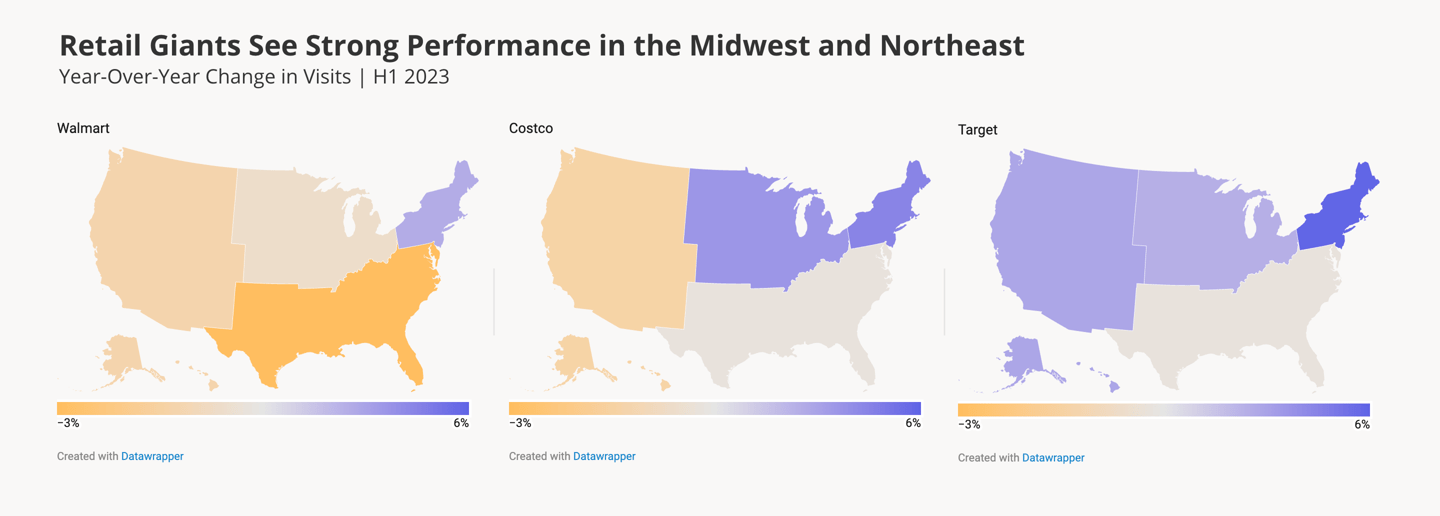

Looking at regional trends, all three chains experienced H1 YoY growth in the Northeast, and to a lesser extent, the Midwest. Walmart saw a 3.4% YoY increase in visits in the Northeast during the first half of 2023, and Costco and Target saw growth rates of 4.8% and 5.9%, respectively, for the same period. In the Midwest, visits showed a more moderate increase, with 0.6%, 4.2%, and 3.3% YoY increase for Walmart, Costco and Target, respectively.

Target saw strong visits at its West stores, experiencing a 3.6% YoY increase in foot traffic, while YoY visits to Walmart and Costco dipped in those areas. Walmart also faced challenges in the South and Southeast, with a 2.9% YoY drop in visits to the region, while the other two chains both saw growth of 1.2%.

New store formats could have fueled some of Target’s success in H12023, according to the white paper. The company operates over 200 Super Targets, along with over 150 small-format locations. Placer.ai data suggests that YoY visits to small-format Target stores have greatly outperformed Super Targets and regular Targets.

The full report from Placer.ai can be found here.