Online Grocery Sales Fall 7% YoY in July

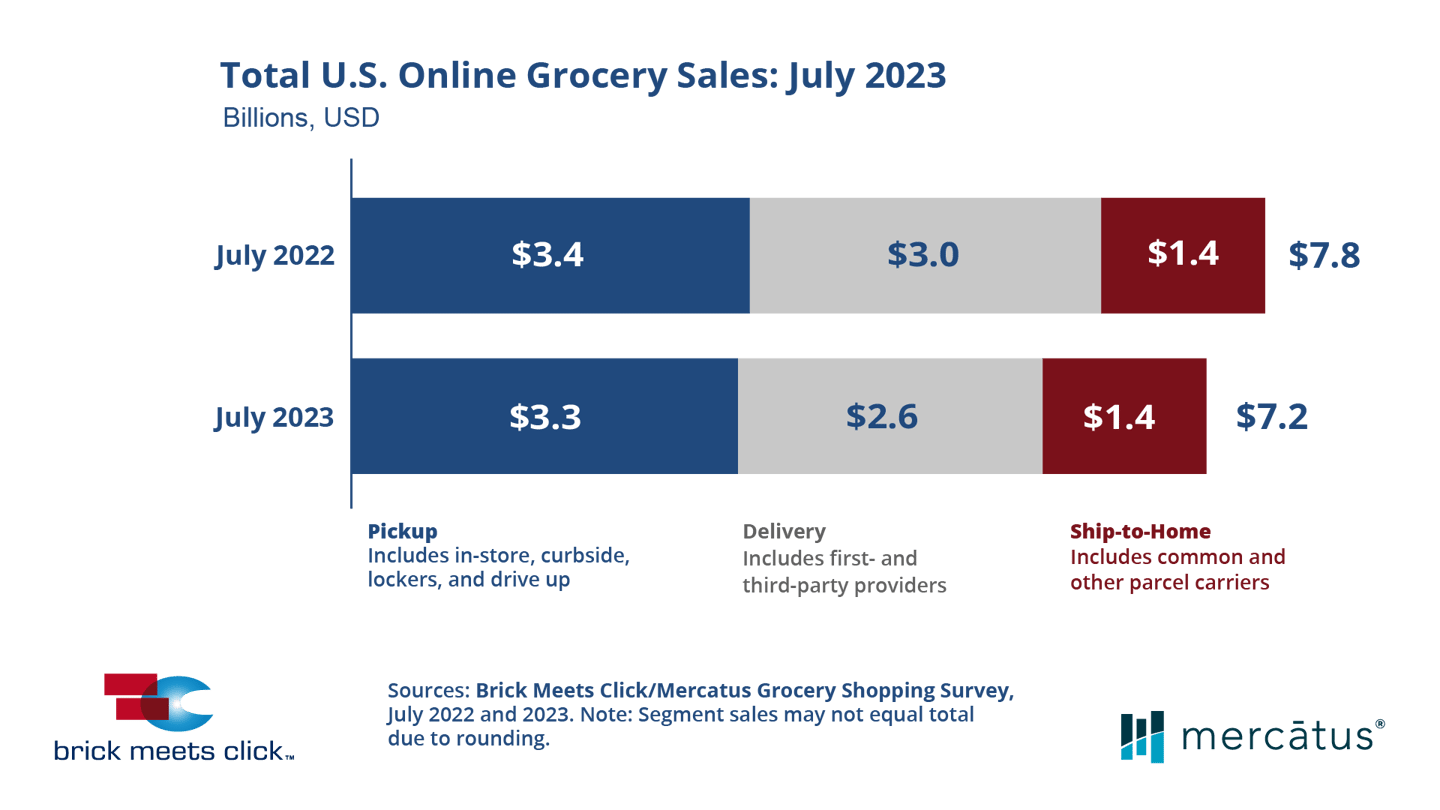

Online grocery sales in the United States totaled $7.2 billion in July, a 7.0% decrease from the same month in 2022, according to the latest monthly Brick Meets Click/Mercatus Grocery Shopping Survey.

Fielded July 29-30, the survey found a decrease in all three receiving methods driven by a decrease in order frequency and decreased spending per order, despite a larger year-over-year (YoY) base of monthly active users (MUAs).

During July, households that bought groceries online increased nearly 5% versus last year, driven by a more than 7% increase in the Pickup MAU base, while Ship-to-Home’s base remained flat and Delivery’s contracted 1% compared to July 2022.

Order frequency, which decreased 10% YoY, was the main contributor to the monthly sales decline, reducing the total number of online orders by nearly 6% for July 2023. Delivery, which dropped 13% versus July 2022, accounted for almost three-quarters of the drop in online orders, while Pickup decreased by 3% and Ship-to-Home by 2%.

“July’s results reflect the growing financial challenges many consumers are facing today,” said David Bishop, partner at Brick Meets Click. “These challenges along with evolving expectations, driven by experience engaging with Mass, are contributing to the growing gap between conventional grocers and their Mass rivals.”

In July, the average order value (AOV) fell approximately 1.5% YoY. Delivery climbed less than one-half a percent, and Ship-to-Home, with the smallest AOV, posted a 1% gain year-over-year. The survey found that neither of these gains was large enough to significantly offset the 2% dip in Pickup’s AOV.

Pickup finished July with a 45% share of online grocery sales, up more than one point compared to July 2022 as its sales slipped 4.5%. Ship-to-Home gained over one share point in July, ending with a 19% sales share and a 1.0% dip in sales. Delivery ceded nearly 2 and one-half points, completing the month with just under a 36% share as its sales fell 12.8%.

Online’s share of total grocery spending declined 130 basis points in July to 13.2% versus last year. Excluding Ship-to-Home, since most conventional supermarkets don’t offer it, the adjusted contribution from Pickup and Delivery finished at 10.7%, down 120 basis points compared to a year ago, due to Delivery’s dramatically weaker performance for the month.

“To drive continued engagement, regional grocers need to offer their customers value for their money and more convenient ways they can save, such as encouraging repeat purchases with promotional offers and easy-to-use digital coupons,” said Sylvain Perrier, president and CEO of Mercatus. “Loyalty programs should be thoughtfully integrated so that rewards are easily accessed and prominently positioned to remind customers of the monetary value they’re receiving.”