Online Grocery Sales Decrease 1.2% in June

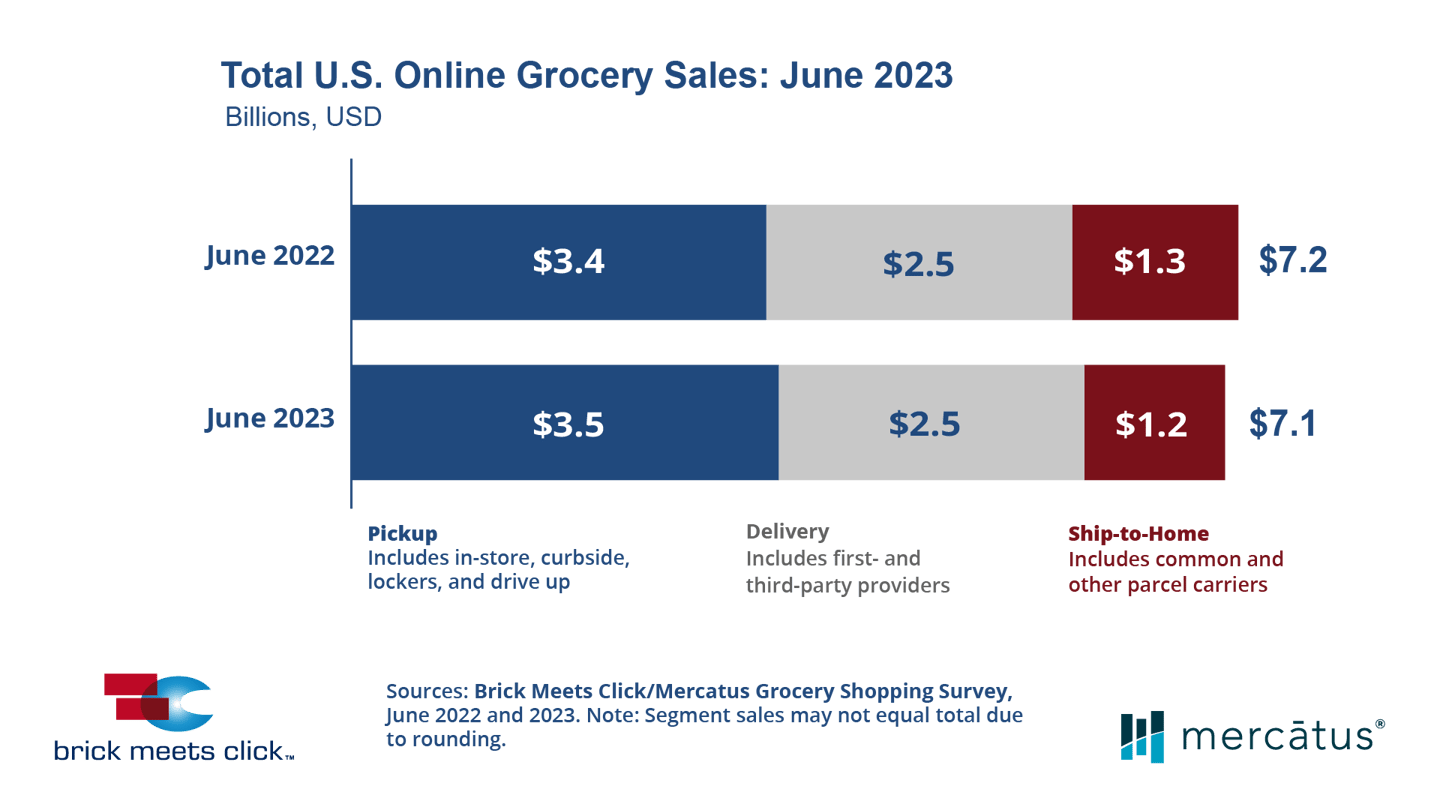

The U.S. online grocery market finished June with $7.1 billion in total sales, down 1.2% year-over-year, according to the latest Brick Meets Click/Mercatus Grocery Shopping Survey.

Fielded June 29-30, 2023, the survey found that more households bought groceries online last month compared to June of last year, but these users completed fewer orders during the month and average order values (AOV) had mixed results across the segments.

The number of monthly active users (MAUs) buying groceries online expanded by slightly more than 1% in June and the overall AOV rose 3% versus a year ago. Despite these increases, the average number of orders completed during the month dropped by 5%. Nearly 70% of MAUs chose to use just one of the three fulfillment methods to receive their online grocery orders, up over 200 basis points (bps) compared to the prior year. Pickup’s penetration rose 140 bps to 56% while Ship-to-Home’s fell 390 bps to 41% and Delivery dipped 250 bps to 39%.

In June, Pickup sales grew 3.2% versus a year ago and accounted for nearly 49% of all eGrocery sales, up 200 bps from last year. According to the survey, sales climbed largely due to an MAU base that expanded almost 4% during the month although its AOV slipped 40 bps on a year-over-year basis.

Delivery dipped for the second straight month, with sales declining 2.5% compared to June last year, causing its sales share to fall by 50 bps to just under 35%. A 5% contraction in MAUs during the month drove most of the sales decline as Delivery’s AOV increased by more than 7% versus last year.

Ship-to-Home saw a 9.7% drop in sales compared to June last year, accounting for just under 17% of all eGrocery purchases during the month, a drop of 150 bps versus a year ago. Lower spending per order was also a factor as its AOV fell 1% on a year-over-year basis.

“Our five-year forecast anticipated that 2023 would be a challenging year for eGrocery so these results generally align with our expectations,” said David Bishop, partner at Brick Meets Click. “So, while Ship-to-Home declines and Delivery has mixed results, Pickup’s stronger performance isn’t surprising as it is becoming more widely available and helps customers who want to shop online save money, which is certainly helpful in the current market.”

The overall repeat intent rate was flat at 63% versus a year ago, ending the three-month decrease reported from March through May of 2023. Online’s share of total grocery spending declined in June, dropping 230 basis points to 11.9% versus last year. Excluding Ship-to-Home, the adjusted contribution from Pickup and Delivery finished at 10.0%, down 160 basis points compared to a year ago, due to Delivery’s weaker performance for the month, according to the survey.

“To elevate customer engagement, regional grocers need to improve the perceived value associated with the online shopping experience,” said Sylvain Perrier, president and CEO, Mercatus. “To achieve this, grocers can focus their efforts on areas like leveraging personalized recommendation algorithms to provide more relevant product suggestions based on individual preferences and past purchases, optimizing the platform’s usability to reduce points of friction, and offering personalized discounts, digital coupons, and loyalty rewards.”