Inflation Hits the Beauty Category, Per Report

Retail data firm DataWeave has released its latest report outlining the state of the beauty CPG industry, giving retailers with private label beauty and cosmetic products insight into the market at large.

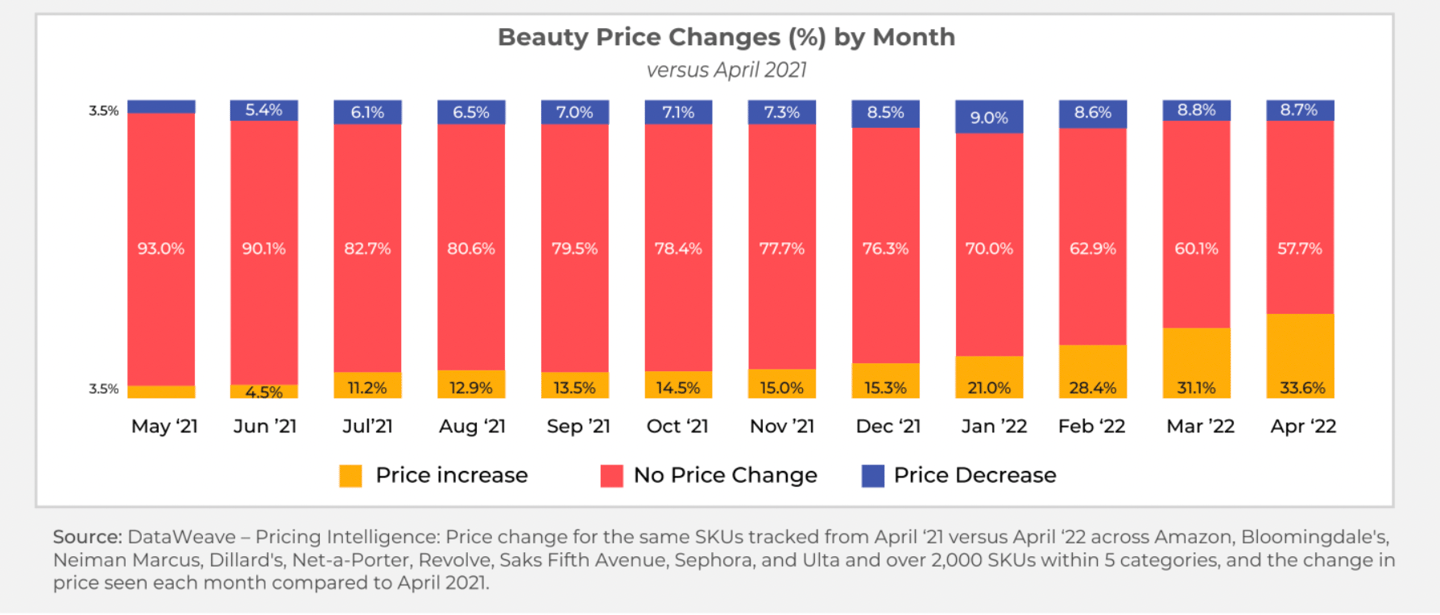

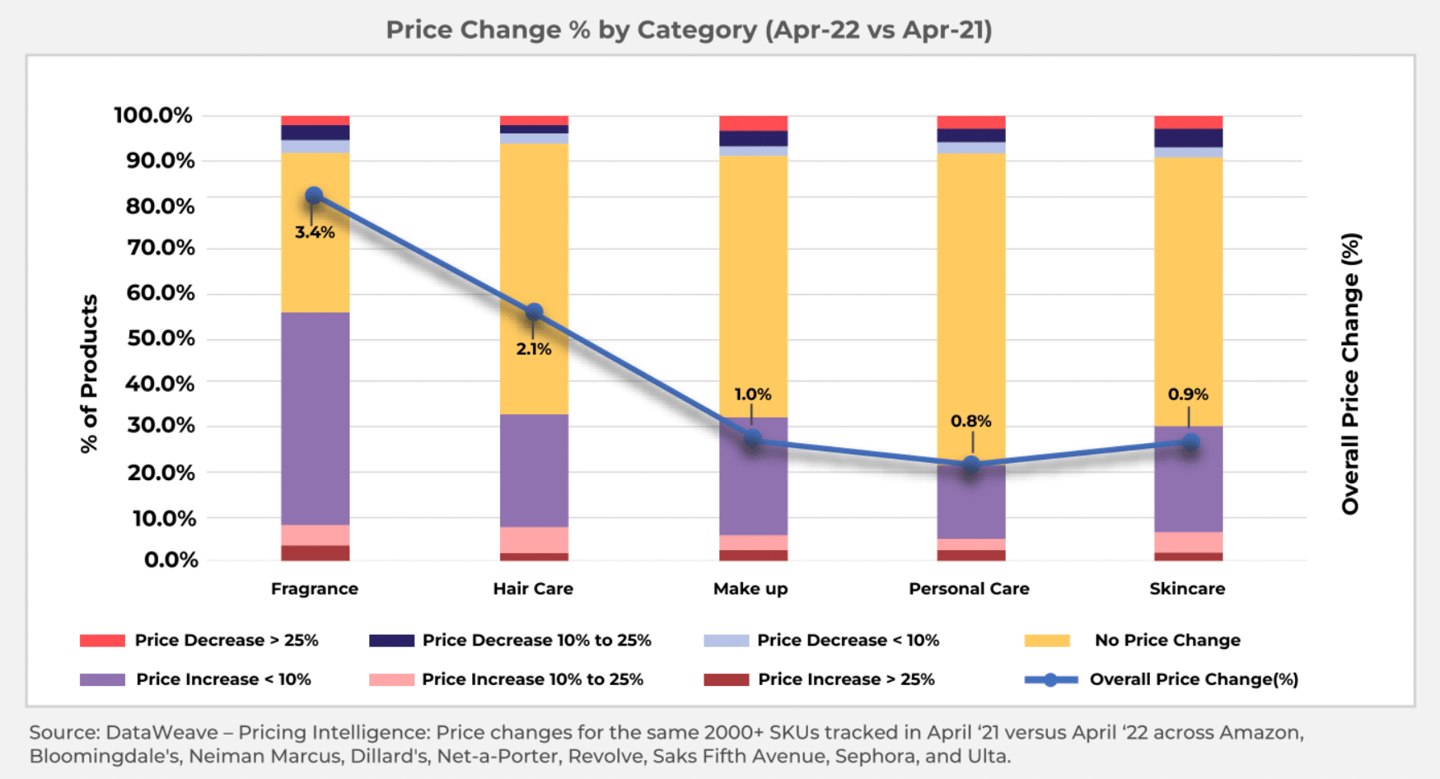

In an analysis of neatly 200,000 SKUs, Optimizing Online Beauty Sales in a Changing Business Environment examines how brands and retailers are adjusting their pricing as inflation continues. Key findings from the DataWeave survey include a strong online demand for beauty CPGs, top brands offering more low and mid-tier priced products and a strengthening digital brand presence is key to improving sales.

“Despite supply chain disruptions, shifting consumer demands and persistent inflationary trends, many retailers fared well during this period (April 2021 to April 2022). While increased production and shipping costs forced most beauty industry players to raise prices on many of their products, smart tech investment and a firm eye on the changing pricing needs of the American consumer have helped top brands and retailers thrive during the period we examined,” said Karthik Bettadapura, CEO of DataWeave. “We will continue to watch the Beauty sector closely, as it may serve as a bellwether for inflationary trends across the retail value chain."

With inflation, prices have risen across the board in the beauty category this year. To combat this, retailers have pushed fewer top-tier price items in efforts to keep consumers buying.

DataWeave analysts predict that these trends are likely to continue as price increases across consumer categories push buyers to make choices in how they spend in the months ahead. With the skincare category in particular on the rise as U.S. beauty shoppers choose skincare products over cosmetics, the report authors suggested that retailers prioritize their skincare inventory.

“Availability and affordability were buzzwords for top beauty brands, who maintained superior in-stock availability through 2021 and into 2022,” said Krishnan Thyagarajan, president and COO of DataWeave. “Across the major beauty brands and retailers we analyzed, the defining trends we identified are a shift toward producing more low and mid-tier items and an expansion of investments in tech-driven consumer marketing.”

A copy of the full report can be found here.