Q&A: A new way to benchmark private brand success

Consumer Science and Solutions for Retail Brands, stylized as S4RB, have partnered to launch a new store brand product benchmarking strategy called the “Consumer Experience Score,” a novel, holistic metric that incorporates attributes such as design, packaging, sustainability and healthfulness, as well as traditional sensory and performance measures.

Previously, retailers only compared a store brand product against a national brand, looking at sales or taste tests, but this new framework looks at a product against other store brand competitors, against multiple categories and more. The companies said in a post-pandemic marketplace, store brands will need to improve how they benchmark.

“Consumers will be more interested in private brands going forward, so this is an ideal time for retailers to boost benchmarking and fine-tune their brand value proposition,” said Chandi Gmuer, vice president of consumer research and product testing at Consumer Science, Fort Worth, Texas. “New kinds of benchmarking are needed to make sure strategies are on target for consumers in this environment, as the discounters Aldi and Lidl did so well back in the financial crisis of 2008.”

James Butcher, CEO at the global consulting-led software business S4RB, spoke exclusively to Store Brands about how retailers can leverage this new metric.

Store Brands: First, how did S4RB and Consumer Science come together for this new benchmarking strategy?

James Butcher: S4RB and Consumer Science have worked together for a number of years with mutual clients.

This specific initiative comes from a shared view that too many retailers are focused on a simple National Brand Equivalent strategy. That strategy was successful. That moved the industry from the generic products of the ’70s and ’80s to the more trusted private brands we have today. However, retailers today strive for increased private brand penetration for two key reasons: because it is their differentiation (increasingly important with the increase of online grocery sales); and, the increased margin from private brands.

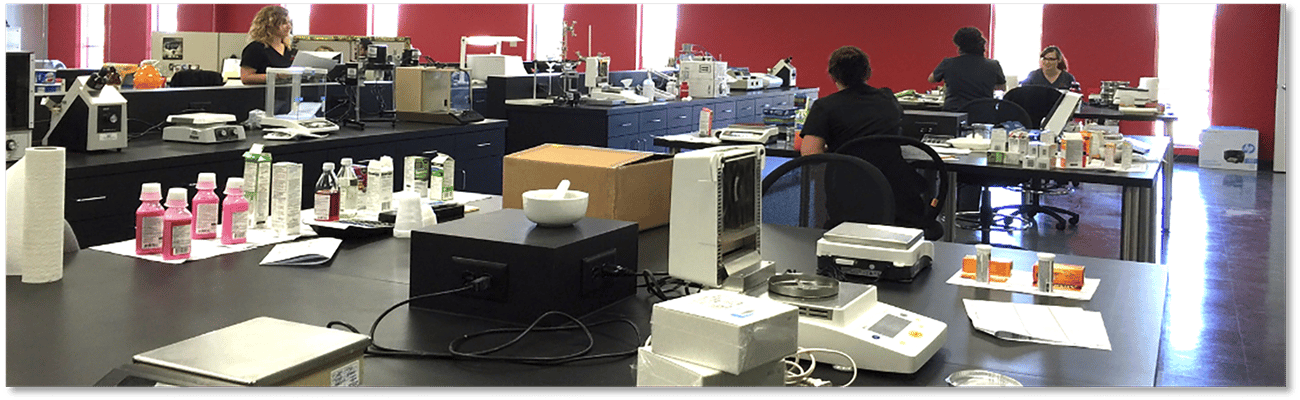

This initiative builds on work that both companies have been doing separately. Consumer Science has provided compliance software and services for product specifications as well as their testing services. And S4RB provides supplier engagement around product development, EPD/NPD, nutrition and change management (e.g. plastic reductions). S4RB has previously worked to provide KPI dashboards and visualizations on Consumer Science data, such as product specification completion/accuracy.

SB: What were you out to solve?

JB: Prompted by conversations with a specific retailer last year, we challenged ourselves on how to review differently and worked together on how this could be achieved. Essentially, with the goal to solve two problems: First, the strategy to increase private brands typically means increasing shelf space for private brands, which would likely happen at the expense of national or regional brands. Therefore, it is no longer sufficient to test against a NBE, but rather it needs to be an informed view against competitive private brands.

Secondly, to move from 10% to 20% private brand penetration to 30%-plus requires more than just "me too" products. It requires a retailer to determine an appropriate value proposition for its brand (brand being the operative word) and benchmark its products against these objectives. This will ensure private brand products deliver not just on price but also against brand values.

SB: Describe the Consumer Experience Score. How does it work?

JB: We worked with Chandi Gmuer and his team at Consumer Science to establish Consumer Experience Score, which relates to category specific metrics that go beyond the traditional measures of taste, texture, aroma and appearance. For example, for pre-packaged salads this could be crunchiness or freshness. It goes beyond product to also consider healthiness, product claims and packaging quality, all of these important attributes when the consumer first engages with a product.

It is not always about being the best. It is about delivering on the brand proposition, consistently. And across categories and a range.

SB: How does this strategy improve upon previous or older thinking in the private brand space?

JB: First, as I’ve described, this takes the thinking and comparison beyond national brand equivalency. But importantly, it allows the comparisons to be made across products or across category. In the past, benchmark tests were very much considered in isolation, such as, “Is this specific product a ‘pass’ or a ‘fail’?” But to act more as brands, which private brand retailers must do in order to be successful, there needs to be a category and range perspective.

This new approach allows a consistent assessment methodology by Consumer Science, which also leverages [Gmuer’s] team to bring its experience to bear in choosing the appropriate product-specific metrics. Moreover, these results can be visualized within S4RB’s Affinity platform, to look across a category, or across a range like “Italian.” This ensures items consistently deliver on brand value and strike the right balance between competitive prices and quality proposition.

SB: What did you learn when you weighed this new strategy against key retailers today?

JB: It cemented our view that too often it appears product comparisons are considered as just that — product comparisons (and often we’d assume against the NBE). Whereas, there is the need to consider the benchmark as a brand.

Oftentimes, a key attribute makes the difference in why a private brand outperforms the another in a category. For example, the crunch and texture provided by croutons is of paramount importance in the Chicken Caesar Salad category (Kroger and Target include them). Those retailers wanting to compete in the premium space should include them. Those wanting to compete in the high value/price fighting segment may consider excluding them with an eye on maintaining margin. Similarly, decorative toppings become a big differentiator in the Hummus category. With this methodology, retailers have the opportunity to better understand these trends and consider if they provide differentiation lessons for other categories as well.

SB: Who were the leaders in what areas and why?

JB: Let’s take the example of the coffee category. Aldi and Walmart were consistently in the High Value and Price fighting sectors, respectively. H-E-B is consistent in the premium positioning with its Café Ole brand. Consistency is important because it avoids confusing consumers. These retailers tend to show consistency across the categories tested.

SB: If interested in using it, how do retailers get involved?

JB: S4RB and Consumer Science are very happy to tailor a presentation and demonstration for retail private brand teams. If any retailers would like to learn more about the process, the technology or sample results from the recent exercise, contact me () or Chandi Gmuer.

SB: How would manufacturers or suppliers leverage this benchmarking strategy, if applicable?

JB: This strategy allows retailers to make decisions on individual products that coalesce around a consistent brand positioning. At S4RB, we believe that retailers should collaborate with their private brand suppliers and work as one team, with one mission, around one view of product performance. We apply that to product development, customer feedback and other measures. And this falls into that same category. Our Affinity platform allows retail private brand teams and their manufacturers or suppliers to collaborate around one view of a product benchmark performance in order to ensure a winning private brand strategy. For example, by using Affinity, these trading partners can have conversations, track the history of the exercises, and take corrective actions, all in support of keeping products true to the brand proposition.

As a retailer, do not just think of it as your product. But do not think of it as the supplier’s product either. You both own the product and work as one team to deliver against the value proposition for mutual success.