Private Label Sales Up In First Half

Sales of private label products were up more than 4% in the first half as store brands made gains across numerous key product categories, according to new data from the Private Label Manufacturers Association and Circana.

For the six months ending June 15th, private label dollar sales were up 4.4%. During the same period, national brand product sales were up 1.1%. Private label unit sales were up 0.4% as national brand unit sales were down 0.6%.

Unit share for private label products continued to grow, hitting 23.2% in the first half. This is a continuation seen over the past two years. In 2023, store brands unit share was 20.5%, rising to 22.9% in 2024.

January accounted for the first half’s largest gains in terms of dollar sales and unit sales. The month served as the inaugural Store Brand Month, a brainchild of PLMA. The initiative was designed to bring together retailers, manufacturers, and service providers to declare January as Store Brands Month.

By category, the largest growth in private label sales over the past 12 weeks were refrigerated foods up 10.5%, beverages up 4%, petcare up 2%, frozen food up 2%, and beauty up 1.6%.

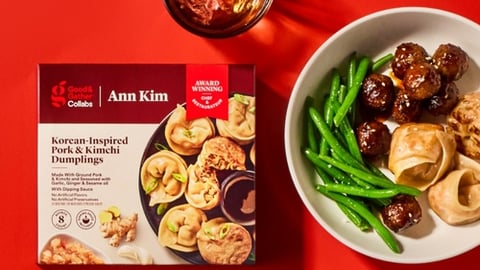

The growth of private label sales during the first half is reflective of the continued growth of store brand products by several leading retailers. Target expanded its Good & Gather brand with the launch of its Collabs line, which features products developed with James Beard-Award winning chefs.

Albertsons this spring debuted its Chef’s Counter assortment, teaming with Chef Antonia Lofaso as its brand ambassador. The initial assortment includes a selection of ready-to-cook marinated meats priced from $4.99 for boneless pork loin chops in mesquite or garlic herb flavors to $12.69 for carne asada.

More recently, CVS revealed plans to overhaul its CVS Brand assortment with new packaging, and Kroger, which reported seven consecutive quarters of private label growth, announced it would introduce 80 new items under its Simple Truth brand.

Additionally, Aldi continues to move forward with its new store opening plans as the discount grocer and selling of private label products expands its presence across the U.S.