Private Label Continues to Gain Market Share Amid Inflation

Market research leader IRI has released new data on how inflation is impacting consumer packaged goods (CPG), with private label continuing to gain share across several categories.

The report, titled Revenue Management in an Inflationary Environment, details changing consumer habits when it comes to CPG purchases and looks at the outlook for pricing, promotion and demand of the products.

“CPGs and retailers will need to remain nimble, closely monitor and adjust to volume responses to price increases and leverage a comprehensive playbook of revenue management levers to drive long-term success while taking price to offset costs this year,” said Krishnakumar “KK” Davey, president of client engagement at IRI.

The report shows that CPG has experienced rapid inflation starting in the second half of 2020, with edible products seeing more inflation than non-edible. Private label gains began to take off when gas prices rose. Store brands gained 6.5% in dollar sales, while national brands increased 5.2% during Q1 of 2022 as gas hit record highs.

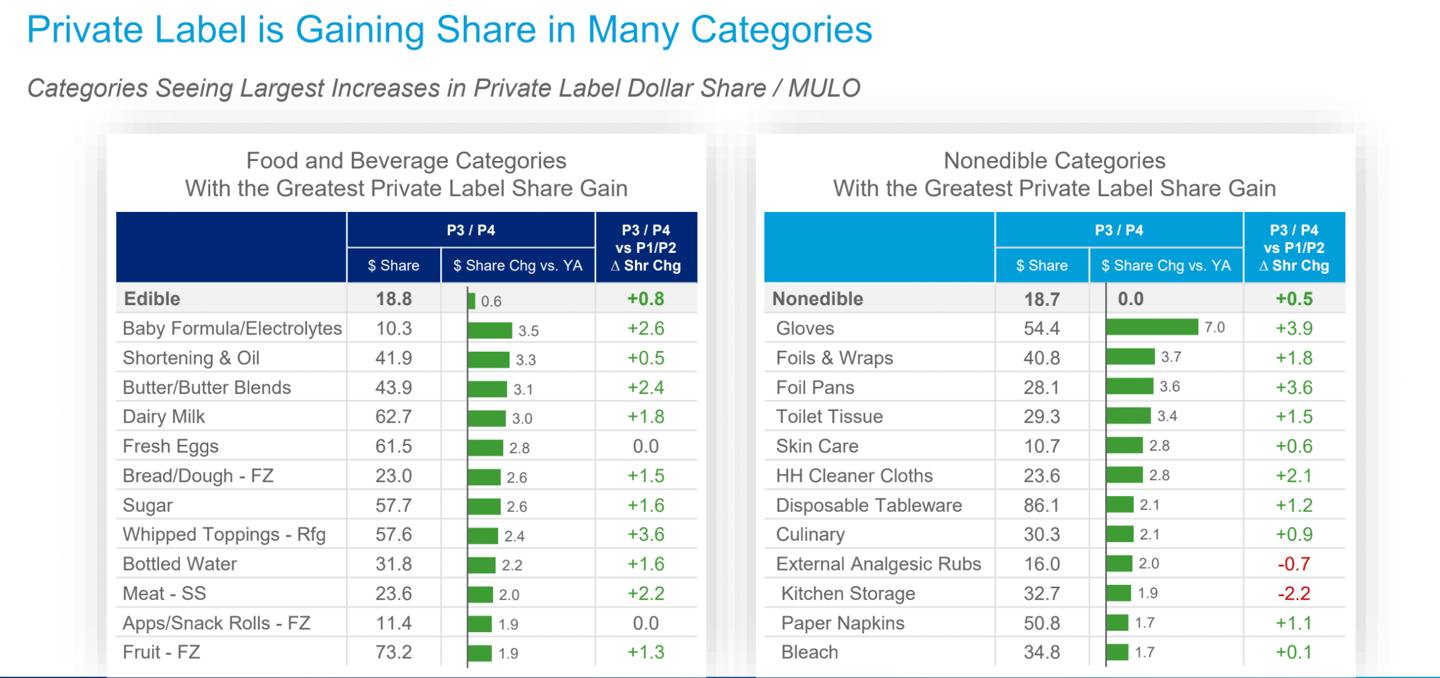

Food and beverage categories that saw the highest share gain in the third and fourth quarters of 2021 include baby formula/electrolytes (+3.3 share change vs. yearly average), shortening & oil (+3.3 share change vs. yearly average), butter/butter blends (+3.1 share change vs. yearly average), and dairy milk (+3 share change vs. yearly average).

In the non-edible category, globes (+7 share change vs. yearly average), foils and wraps (+3.7 share change vs. yearly average), foil pans (+3.6 share change vs. yearly average) and toilet tissue (+3.4 share change vs. yearly average) saw the largest gains for private label.

The full report from IRI can be found here.