How Amazon and Walmart's E-Commerce Compare

Jungle Scout, an Amazon-focused e-commerce firm, has shared a new report detailing how two of America’s biggest retailers, Amazon and Walmart, stack up against each other.

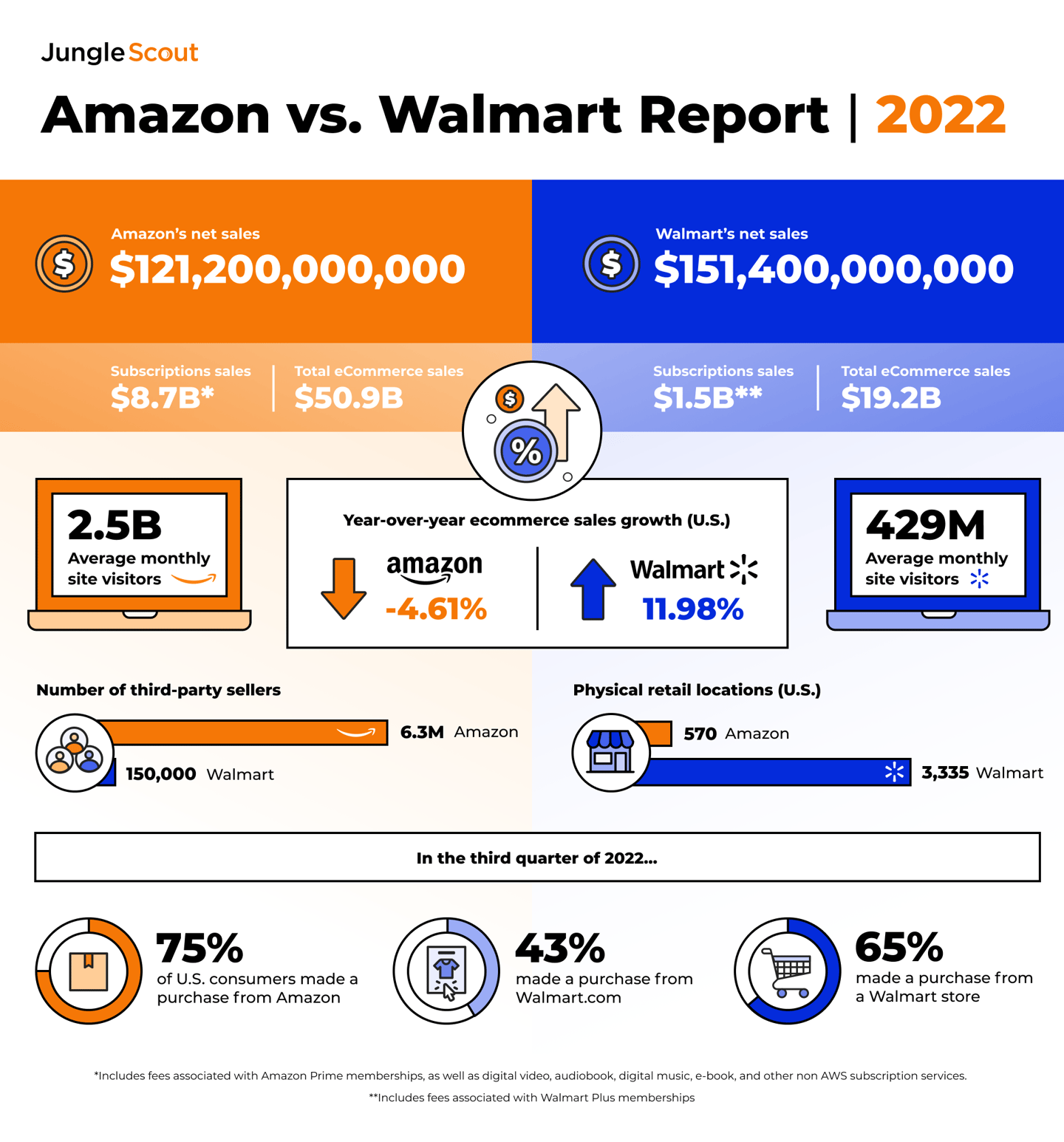

The new 2022 Amazon vs. Walmart Report studied more than 1,000 U.S. consumers and financial reports from the two companies with large private label businesses. The report found that Amazon is still maintaining its e-commerce dominance, but more customers go to Walmart for affordable items and everyday needs.

"The retail environment is constantly changing due to economic currents and consumer whims. Amazon and Walmart are both leveraging online and offline technologies as a way for brands to create more dynamic solutions that satisfy their customers," says Michael Scheschuk, president of Small & Medium Business and chief marketing officer at Jungle Scout. "Investments like Amazon's Dash Cart in Amazon Fresh stores and Walmart's Virtual Try-On in their iOS app will raise the bar for all retailers and improve consumer experiences."

When it comes to e-commerce, 75% of U.S. consumers have purchased from Amazon recently, compared to 43% who have shopped on Walmart.com in Q3 of this year. More than half (63%) of consumers begin their search for a product online on Amazon over Walmart.com (43%), with Amazon-preferred categories including electronics, books and clothing.

Additionally, more consumers in the survey had Amazon Prime memberships (57%) than Walmart Plus memberships (31%). Despite Amazon’s e-commerce dominance, Walmart’s e-commerce sales grew 11.98% since last year, compared to Amazon’s sales decreasing by 4.61%. Jungle Scout reports that Amazon has 2.5 billion average site visitors monthly, while Walmart sees 429 million average monthly site visitors.

With inflation continuing to impact consumers, Walmart remains a go-to retailer for groceries and other everyday essentials, such as medicine and cleaning supplies. Over half (56%) of consumers turn to Walmart for groceries, compared to 15% who prefer to buy them from Amazon. 43% of consumers say product prices are the main reason they shop at Walmart over Amazon, followed by familiarity with products. A vast majority (71%) of consumers are more likely to make smaller purchases ($0-99) from Walmart.com, compared to 66% on Amazon.

The full report from Jungle Scout can be found here.