Eagle Eye: Consumers Seek Promotions, Private Label to Build Loyalty

A large number of consumers are looking for personalized promotions and strong private label value to help build loyalty to a retailer, according to a new report from digital marketing company Eagle Eye.

According to the Grocery’s Great Loyalty Opportunity Report, 84% of consumers surveyed believe personalized recommendations will help them save at the shelf, and 71% of those surveyed would either consider buying a product or find the information helpful if they received a promotion or offer while shopping in a store. A large majority (69%) of consumers view value as the most important factor when choosing a brand

"This is an uncertain environment for retailers, but consumers are also primed to appreciate the value of loyalty," said Tim Mason, CEO of Eagle Eye. "Grocery retailers are uniquely positioned to use their loyalty programs to deliver the savings their customers demand and the experiences they’ve come to expect."

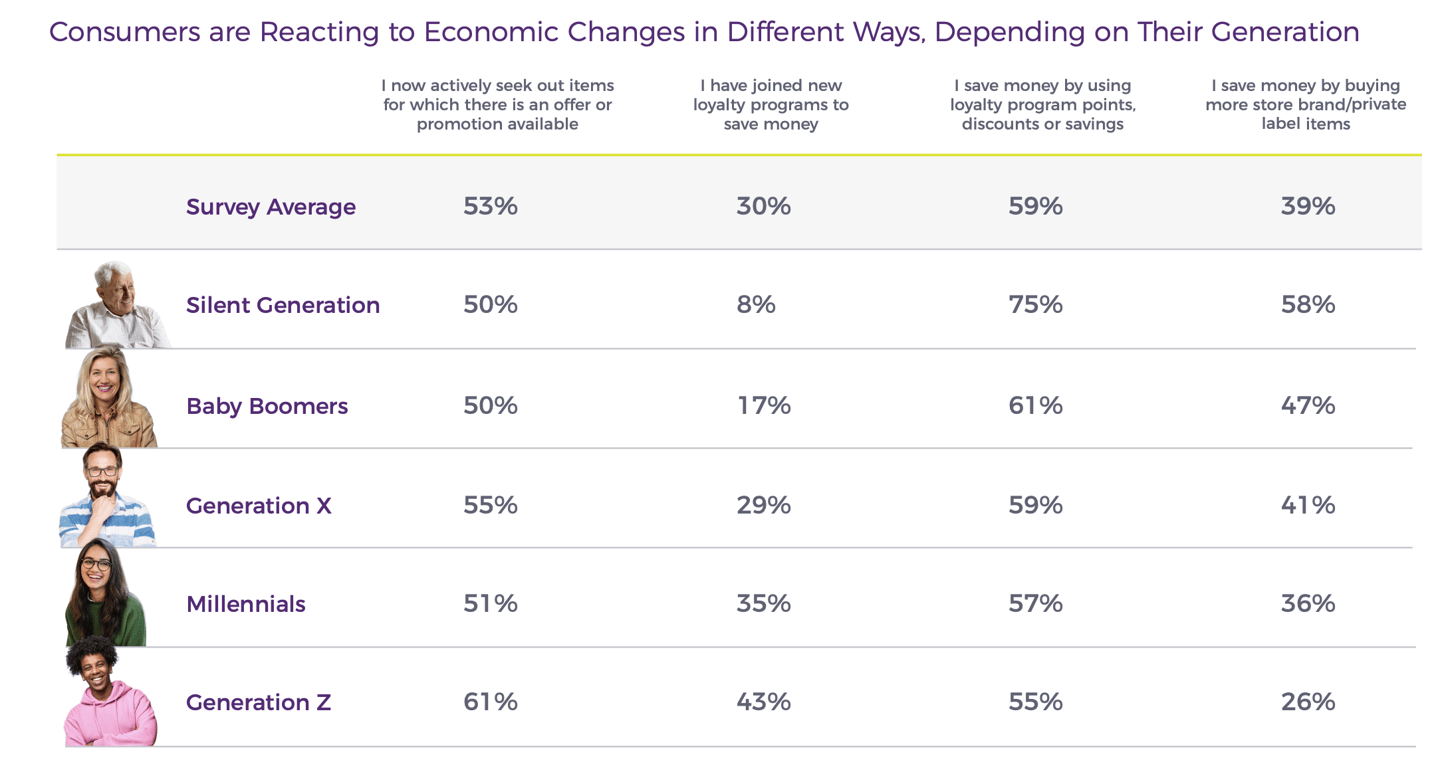

According to the Eagle Eye survey, 39% of consumers buy private brands to save money, with the Silent Generation (58%) and Baby Boomers (47%) topping the age cohorts. Overall, 53% of consumers said they actively seek out items on promotion to save money, and 59% save money on groceries by using a loyalty program.

Of those that use loyalty programs, 76% of members think retailers could offer more private label products to help them save more. However, only 41% of grocery loyalty program managers say they plan to offer more private label products over the next 3-6 months.

From the retailer perspective of the survey, 37% said they planned on offering more private label products in the next 3-6 months. Making it easier to redeem loyalty points (54%) and deliver relevant discount offers (48%) topped the list.

“The gap between shoppers’ willingness to participate in games and contests and retailers' plans to invest in these capabilities isn’t the only divergence between consumer demand and loyalty program priorities,” said Eagle Eye in the report. “In fact, we see the same tentative approach to real-time promotions and offering a wider range of private label products, even as consumers state their preferences for these initiatives by wide margins.”

The full report can be found here.