Candy Prices Rise Ahead of Halloween

Candy prices have surged year-over-year with Halloween around the corner, according to shopper intelligence platform Catalina.

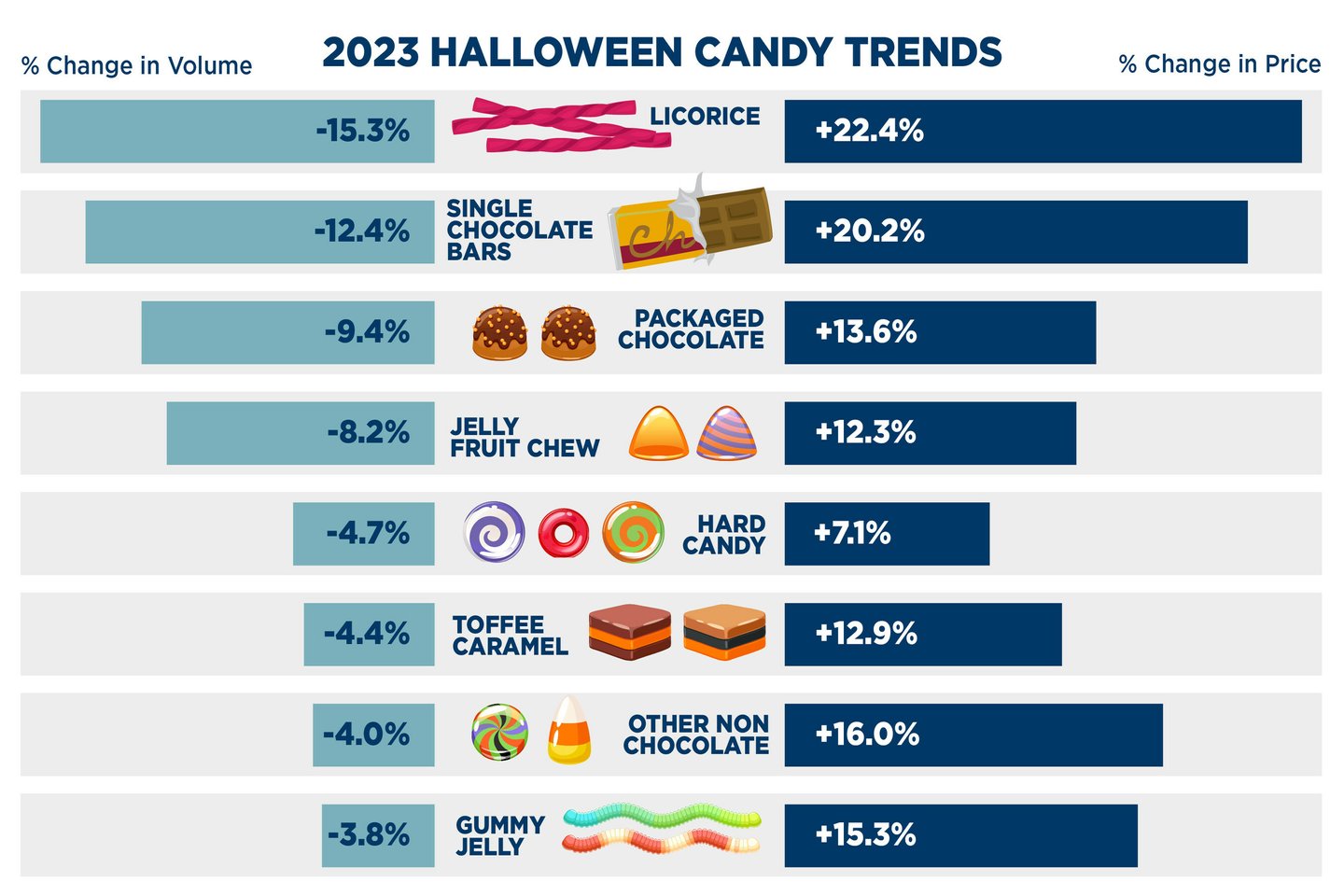

According to new data, for the 13-week period ended Aug. 21, average candy volume decreased by 8%, while overall prices increased by 16%. The candy types with unit sales decreasing the most since this time last year are licorice (-15%), followed by single chocolate bars (-12%), packaged chocolate (-9%) and fruit chew candies (-8%). The categories with the greatest unit sales decreases – licorice and single chocolate bars – also saw the greatest price increases at +22% and 20% respectively.

Despite significant price increases, toffee/caramel (+13%), Other non-chocolate candies (+16%) and gummy/jelly candies (+15%) saw only single-digit unit sales decline by 4.4%, 4% and 3.8% respectively.

“Significant price hikes for candy this past year have opened the door for retailers to gain share by increasing promotions of their private label sweets in the weeks leading up to Halloween,” Phyllis Johnson, group director of Brand Retail Development at Catalina, told Store Brands. "While branded loyalty in the candy category is still very high, cracks are starting to appear in their stronghold over Halloween as shoppers increasingly look for value everywhere. They are willing to try new products but not willing to compromise on quality and taste.”

To combat these price increases, Catalina recommends a five-step process for retailers. After targeting frequent brand and category buyers based on purchase-based insights, the next step is to deliver engaging, omni-channel messaging at every point in the shopper journey, according to Catalian, with the aim of selling at the threshold goal in a single shopping trip. Afterwards, Catalina said retailers should reward shoppers with cash back on their next trip while measuring shopper behavior to gain valuable insights ahead of the holiday season.

“With more shoppers purchasing private label brands, the time has never been better for retailers to leverage the opportunity to expand or create private label offerings that differentiate them in the market and give shoppers a reason to shop Halloween in their stores,” added Johnson. “Value seeking and trading down are here to stay for a while.”