84.51° Details Halloween Spending, Inflation and Kroger's Private Brands

It’s no secret that high inflation is continuing to impact Americans’ shopping habits, including many shoppers switching to private brands for groceries and household goods. In its latest Consumer Digest report for the month of September, 84.51°, Kroger’s retail data and insights company, detailed how consumers say they are planning to shop with Halloween around the corner and Thanksgiving and Christmas on the horizon.

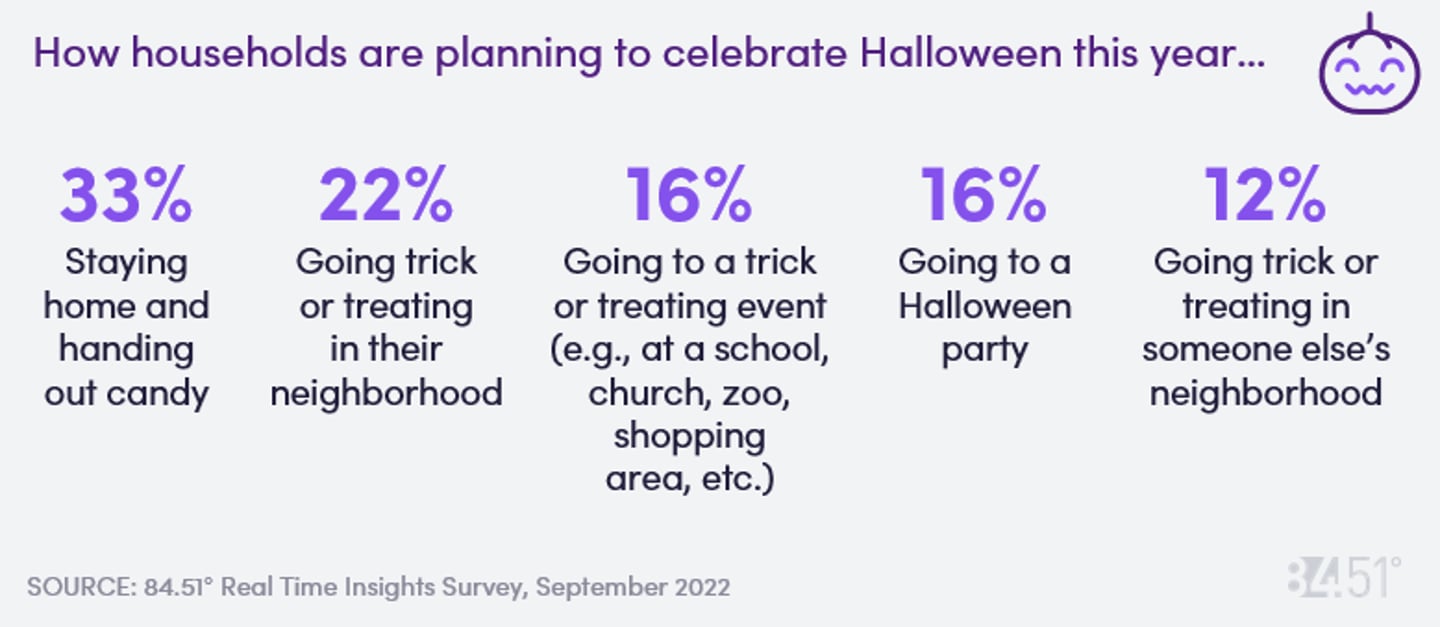

While candy sales are expected to rise compared to last year according to the National Confectioners Association, many consumers say they will cut back on buying. According to 84.51°’s latest data, 33% of those surveyed said they planned to spend less on candy ahead of Halloween. 41% said they planned to spend less on decor, and 24% said they planned to cut back on what they spend towards costumes. Overall, roughly a third (31%) of those surveyed said they don’t plan on celebrating Halloween at all.

At Groceryshop 2022, held Sept. 19-22 in Las Vegas, NV, Store Brands sat down with Michael McGowan, SVP of insights & loyalty at 84.51°, to discuss the recent findings, and how Kroger is leveraging its portfolio of private label brands during the ongoing inflationary period.

“We are hearing and seeing from customers that inflation is influencing the way they spend and the way that they are able to meet their needs,” said McGowan, adding that many consumers are looking to cut spending on non-essential items this holiday season. “They’ve said ‘I’ll probably spend less on halloween decorations,’ things like costumes.”

The latest 84.51°data shows that 90% of shoppers acknowledge making changes at the grocery store due to high prices, even households making more than $100,000 per year. Higher income households are more likely to switch to bulk options and out of more premium products, while others are more likely to cut spending altogether and/or switch to private brands.

“Households that are projected to be less than $100,000 in income, 45% have said are ordering less pizza out and transitioning to frozen pizza,” McGowan said. “That’s a good indication of folks being more cost conscious… it doesn’t mean they’re not eating pizza, it means how they choose to fill that need for their family is different.”

McGowan added that having a wide variety of private label products is key for retailers as inflation continues with the holidays ahead.

“You want to have the diversity of assortment that matters to customers,” he said. “We see around holidays that customers tend to be very purposeful about the products they get. They want quality products at reasonable values. 21% of customers this past month told us that they are planning to gather with more people than last year to celebrate the upcoming holiday stretch. I do think we’ll still see a good mix of individuals using national brands, using selective elements of private label brands, and I’m interested to see if we see more home meal occasions, because that often provides more financial efficiency for customers.”

The full Consumer Digest: September report can be found here.