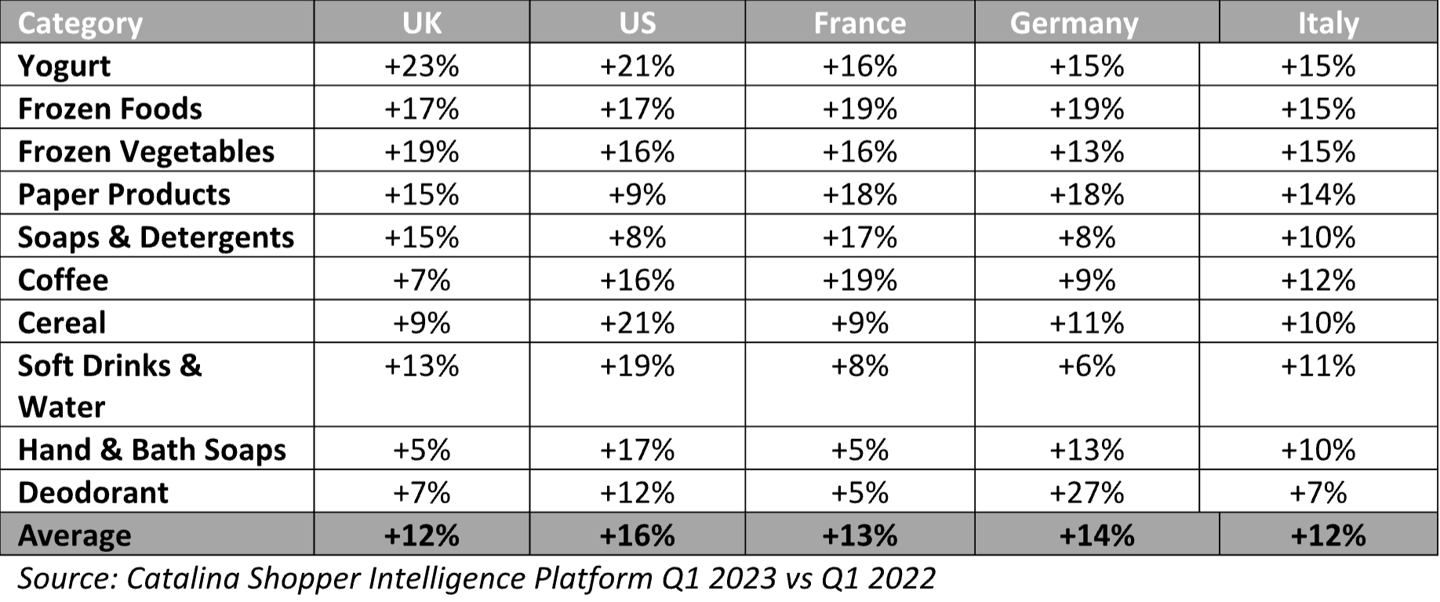

Yogurt, Cereal, Frozen Foods See Highest Price Increases Since Last Year in Q1

Yogurt, frozen foods and cereal are among the food categories that have seen the largest price increases since last year in the United States, according to Catalina’s Q1 2023 Shopping Basket Index.

The index from the shopper intelligence platform examined the aggregate price increase of 10 common product categories in the U.S., U.K., Italy, France and Germany compared to the same period in 2022. On average, yogurt prices rose the most in Q1 of 2023, up 18%, closely followed by frozen food (+17%) and frozen vegetables (+16%).

“A number of factors have been driving up prices in Europe and the U.S., including the war in Ukraine, lingering supply chain disruptions, and rising aluminum, ingredient, labor and energy costs,” said Sean Murphy, chief data & analytics officer at Catalina. “In response, we’re seeing CPG marketers and retailers place more emphasis on promotions and price incentives and we’re working more closely with them to earn the loyalty of value-conscious shoppers with highly personalized offers.”

In the U.S., yogurt and cereal prices both rose 21% year-over-year, followed by soft drinks & water (+19%), frozen foods (+17%), hand & bath soaps (+17%) frozen vegetables (+19%) and coffee (+16%). Paper products (+9%), soaps and detergent (+8%) and deodorant (+12%) also saw increases.

Overall, food inflation for the U.S. in Q1 2023 was up 7% compared to Q1 2022. In the U.K., food inflation is up 7% as well, followed by Italy (+6%), France (+5%) and Germany (+5%).

Increased food prices in the U.S. continue to push shoppers towards private brands. According to Circana data, store brand dollar volume jumped 10.3% year-over-year as of March 26. The growth is nearly twice that of national brands (which grew 5.6%), compared to the same three-month period a year ago.

“We continue to advise our customers that these challenging economic times are an opportunity for brands to fine-tune their omni-channel approach to deliver relevant offers and valuable incentives to help shoppers make the most of their dollars,” added Murphy.