Walmart's Online Sales Hit New High

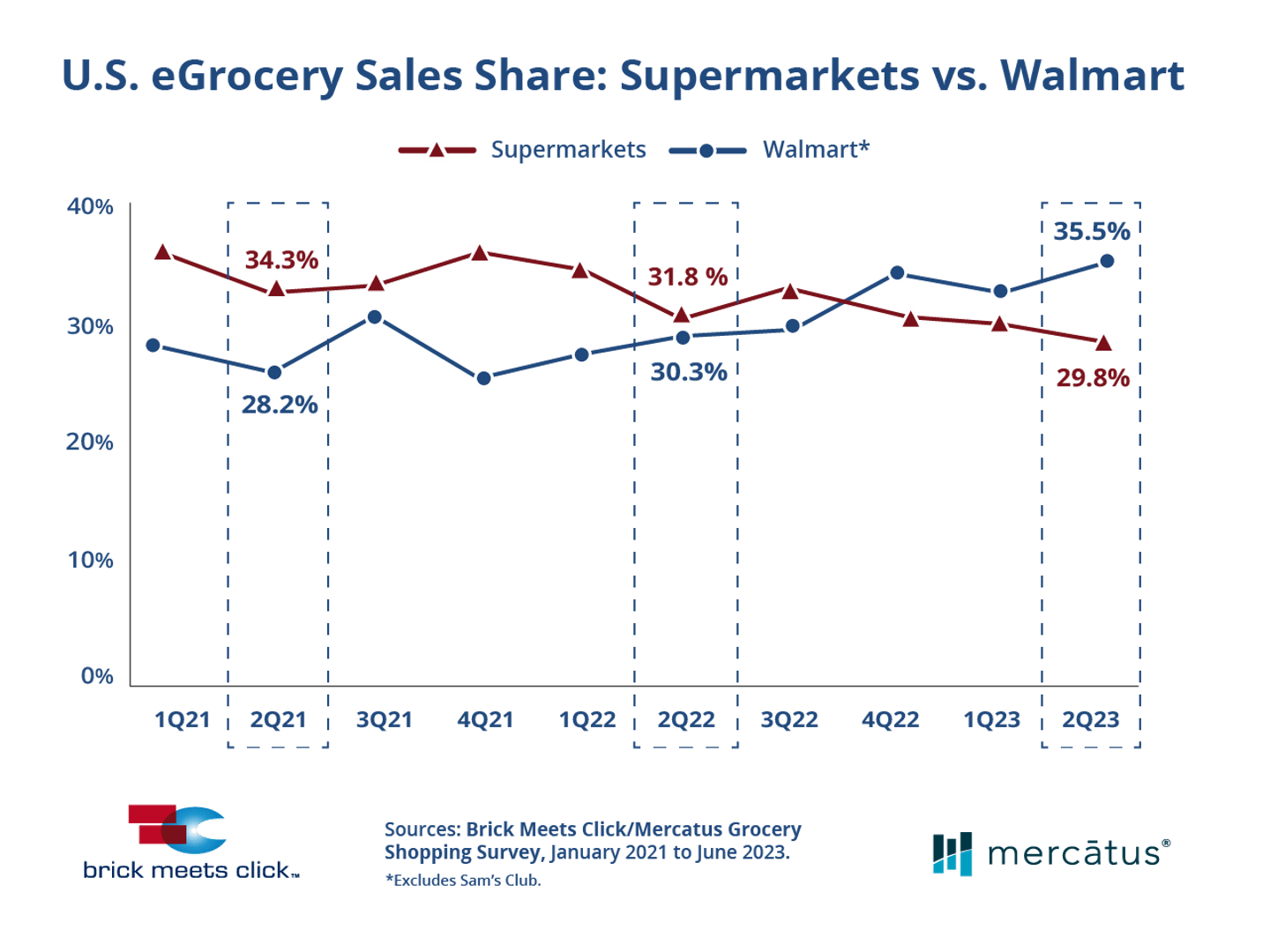

Online grocery sales from Walmart hit an all-time high in Q2 2023, capturing 36% of all e-commerce sales, according to Brick Meets Click’s latest report.

The period marks the third consecutive quarter where the retail giant’s only sales have been higher than that of supermarkets. According to the report, titled Measuring the Online Grocery Market: eGrocery Share in the U.S., Walmart’s share of all online grocery sales was 5% higher compared to Q2 2022.

In Q3 2022, Walmart’s share (excluding Sam’s Club) first surpassed supermarkets’, as sustained inflation led consumers to seek value. Since that period, traditional grocery’s share of the e-commerce market has declined, making up for 29.8% of the market in Q2 2023.

“The combined effect of price inflation and the expiration of COVID financial supports has triggered a flight-to-value as purchasing power remains under pressure,” said David Bishop, partner at Brick Meets Click. “This means it’s vital for grocers to offer customers more ways to save money while also providing the experience that online shoppers expect, as cost considerations will weigh more heavily than convenience for cash-strapped households in the second half of this year.”

Brick Meets Click data shows that Walmart completed the second quarter with a 570-basis point share (bps) advantage over supermarkets. In the second quarter of 2022, traditional grocers led Walmart by 150 bps. The latest report, sponsored by Mercatus, showed that Walmart’s share of overall online pickup orders reached 48% during the second quarter, also an improvement over 2022.

Brick Meets Click found that another retailer, Target, also saw e-commerce gains in the quarter. The retailer held about 7% of e-grocery sales during Q2, up 70 bps on a two-year stack. The report attributed Target’s success to its e-commerce execution and pricing that is “halfway between supermarkets and Walmart.”

“As competition for the shopper intensifies, regional grocers should be leveraging analytics and insights to provide customers with personalized recommendations, discounts, and offers as well as developing targeted, cost-effective strategies to encourage and reward repeat purchases online and in-store,” said Sylvain Perrier, president and CEO of Mercatus. “In addition, grocers can expand the online market they serve by offering pickup as a lower-cost alternative to delivery.”