Walmart, Target Among Retailers Best Positioned Heading into Back-To-School Season

With July winding down, retail traffic analytics firm Placer.ai has published a new report that details which retailers are well positioned to benefit from this year’s back-to-school season.

“Last year’s back-to-school season coincided with the wider post-vaccination brick-and-mortar reopening and the timing drove exceptionally high foot traffic as consumers flocked to their favorite stores to spend their savings from the previous year,” said Placer.ai in the report. “This year, the retail landscape looks quite different, with shoppers looking to stretch their budgets and avoid unnecessary expenses in the face of rising inflation.”

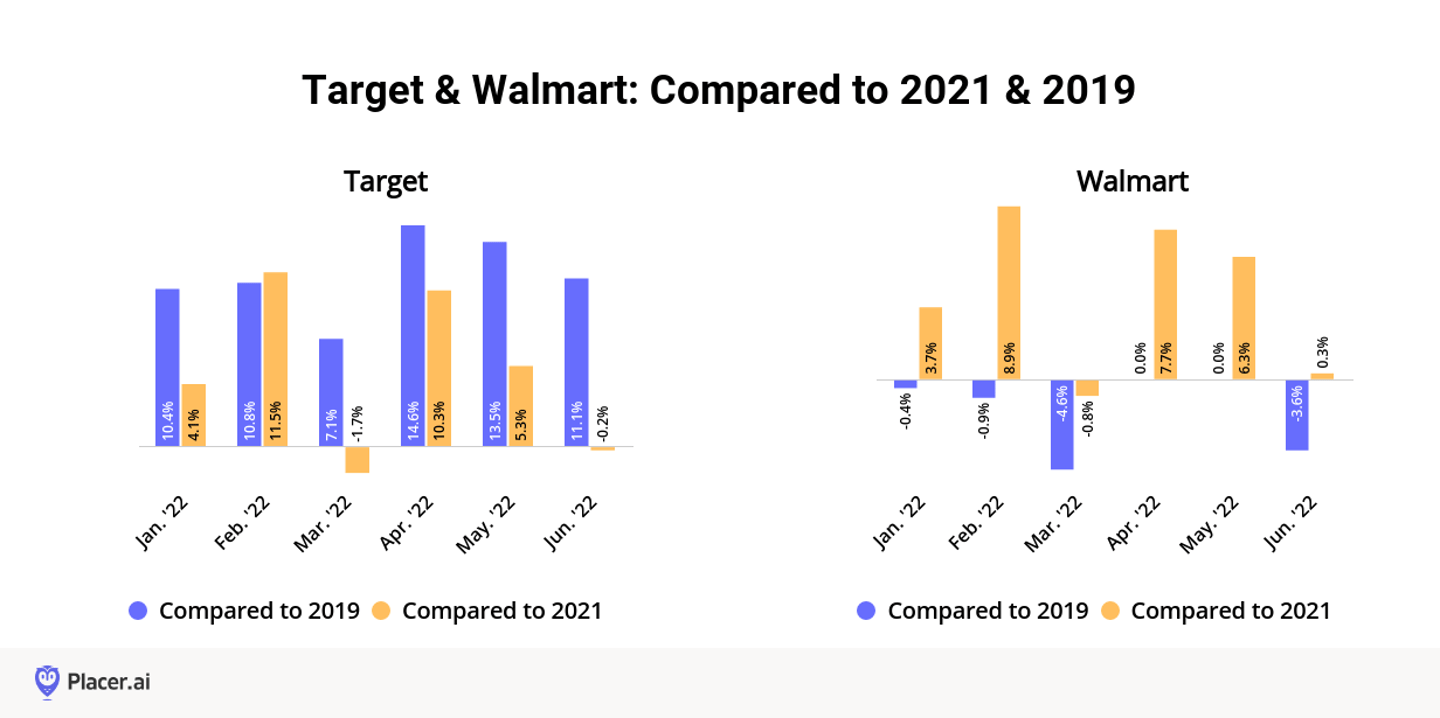

Heading into August, Walmart and Target are still the dominant retailers when it comes to back-to-school shopping, given their strong collection of private brands. Compared to 2019, Target has seen impressive growth, with visits up 11.1% in June 2022 compared to 2019 and up 13.5% in May 2022 compared to three years ago.

Walmart’s increase in foot traffic to start 2022 has been a large increase since 2021, with traffic increasing 7.7% and 6.3% in April and May compared to last year. Placer.ai predicts that both retailers will have success in the coming month due to the ‘one-stop-shop’ advantage they provide to shoppers.

Dollar and discount chains are also poised to thrive, given large increases in traffic. Placer.ai’s recent report on the retail category found that in Q2 2022, the top four dollar retailers saw a combined 8% increase in visits compared to Q2 2021, a 20.5% increase compared to Q2 2019 and a 13.2% increase from Q1 of this year. This growth is expected to continue as shoppers look for deals on notebooks, pencils, backpacks and more.

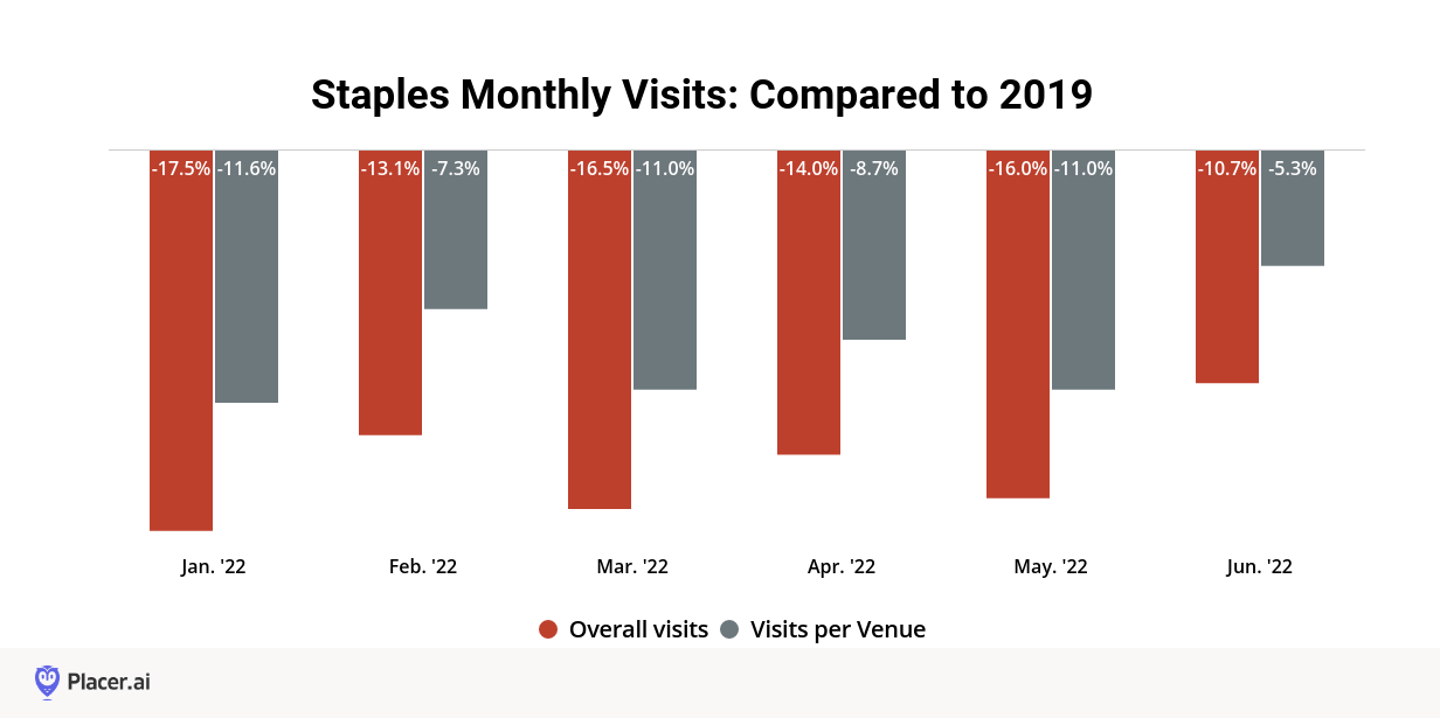

Finally, the back-to-school report examined Staples’ presence heading into August. While visits have dropped dramatically since 2019, June 2022 saw traffic numbers improve, with monthly visits down only 10.7% compared to June 2019, and visits per venue down only 5.3%.

“On the one hand, inflation may be inhibiting consumers from splurging on too much school supplies,” said Placer.ai. “But this is also the first year since 2019 with no remote learning on the horizon, which may prompt parents to invest more in backpacks, clothing, and other back-to-school essentials for learning in the physical classroom. Brands that can cater to consumers’ current value orientation while offering an appropriate and diversified product mix are those most likely to thrive.”

The full report from Placer.ai can be found here.