SNAP shoppers weigh in on private label

The Private Label Manufacturers Association (PLMA) has conducted a new consumer research study that could shape the way retailers promote their store brand products. The nationwide survey looked at the habits and attitudes of Supplemental Nutrition Assistance Program (SNAP) participants towards shopping for food with their monthly benefits, with a particular focus on their purchases of store brand products.

“The purpose of the survey is to create a roadmap of ways retailers can encourage SNAP customers to spend more of their benefits on store brands with aggressive promotional strategies, especially during the first two weeks of each month when most states reload recipients’ EBT cards,” said PLMA. “The opportunities are vast. SNAP participants represent a formidable market: They will control buying power of about $100 billion in the U.S. grocery food space this year, based on USDA data.”

Of the 505 SNAP recipients who completed the PLMA survey, 70% were female, 30% male; 48% were single, 28% married, and 16% divorced. As for their SNAP participation, 37% have been receiving program benefits for about five years or more, 25% for about one year, and 24% for six months or less. Looking at total household income last year, 70% said it was below $35,000. Some 33% had a full-time job, 11% had a part-time job , 38% were unemployed, and 8% were looking for work.

PLMA’s SNAP survey, which was conducted in early 2021, highlighted 10 main takeaways that retailers can use when orienting their selection of private label and branded items:

- Store brands are highly rated by SNAP recipients

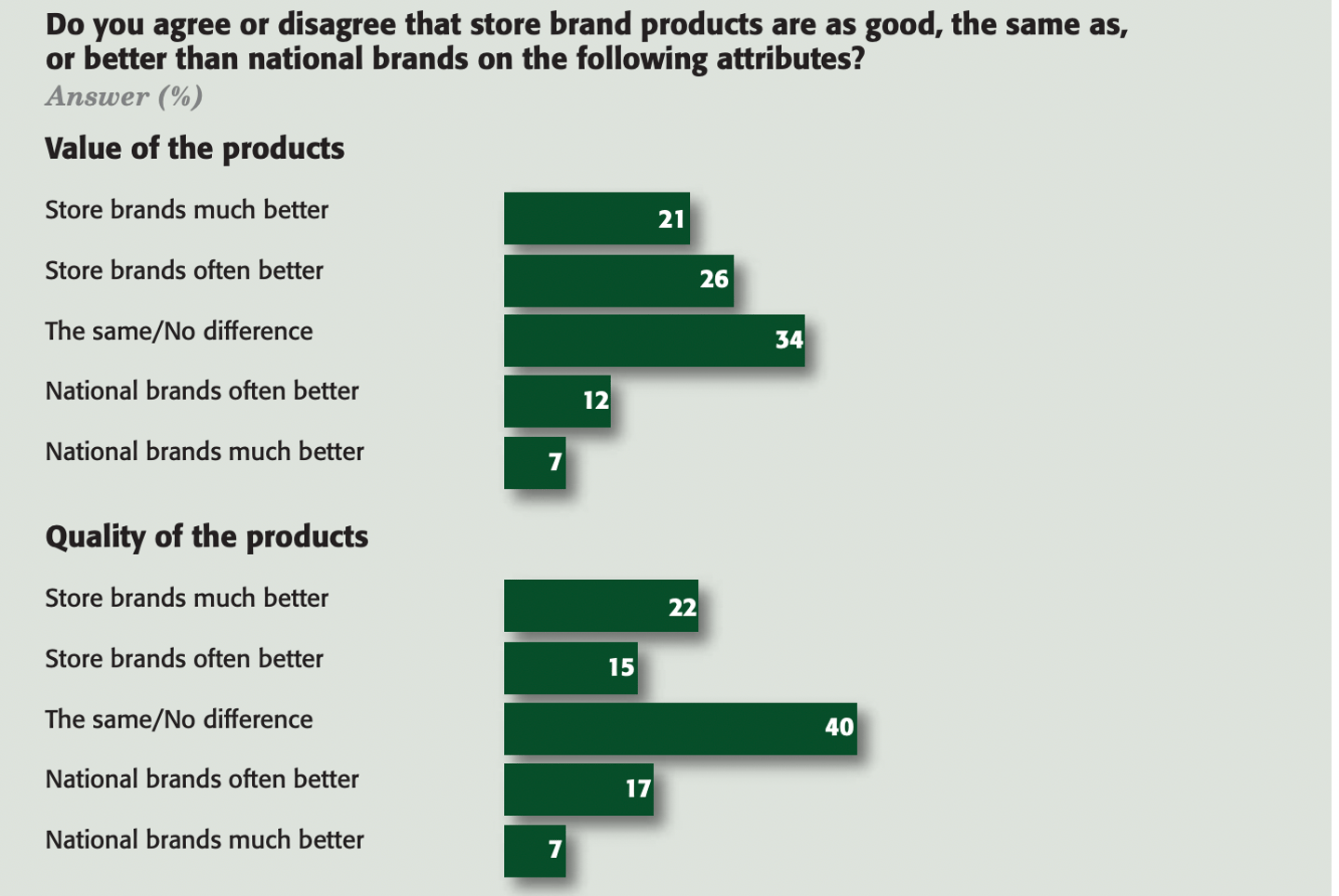

Participants expressed a very favorable opinion of store brands in general when measured against national brands. When asked to compare them to the brands on six important product attributes, they rated store brands better than national brands on all but one. The widest margin was on value, where 47% of participants evaluated store brands as better than branded products, which were selected as better by 19%. On quality, 37% chose store brands as better vs. 24% who opted for national brands.

- In overwhelming numbers, SNAP shoppers are familiar with store brands and have found them satisfying

Respondents’ overall awareness of store brands and their satisfaction with the products are both high, the study shows. Seven of ten in the PLMA study said they are very aware of the private label versions of the food products they would normally buy when shopping in their favorite stores. One in four are somewhat aware, and only 3% were not very aware. Also, nearly four of 10 reported that they are very satisfied with the store brand products they have purchased in the past.

- Each time they shop, three in 10 SNAP recipients purchase store brands at at high rate

Approximately, 24% of the shoppers in the study reported they buy mostly store brands when they use their benefits to buy food products. Another 5% said they generally buy all store brands. On the other end of the brand spectrum, 12% buy mostly national brands each time they spend their benefits, and 10% said they buy all national brands. The largest group, 33%, buy about half national brand products and half store brand products.

- Even staunch national brand customers have good words for store brands

Among those who buy all national brands with their SNAP benefits, 18% said they are satisfied overall with store brands they have purchased in the past. Of those who buy mostly national brands, 23% of them expressed similar satisfaction with store brands. The group may be receptive to taking another look at store brands when they shop with their benefits, and of those who buy all national brands, 29% of them said it would be helpful if store brands were marked as approved for SNAP purchase.

- Majority of SNAP recipients in the study are careful shoppers

Eight in 10 participants always or frequently buy SNAP eligible products when they are on sale. Eight in 10 typically use all or nearly all of their benefits each month, and six in ten said they would find it helpful to see SNAP items marked as such on supermarket shelves. If their favorite food stores were to provide a way to accept their SNAP benefits for online shopping, as more retail chains are beginning to do, almost half of participants would always or frequently use such a service to order SNAP approved food products.

- Respondents shop across a variety of channels for SNAP eligible food products

When asked what kinds of stores they generally shop at using the SNAP benefits, 66% of recipients in the study said supermarkets such as Kroger, Safeway, and Albertsons; 59% cited mass merchandisers like Walmart and Target; 47% said dollar stores, 26% cited discounters like Aldi, 26% said drug stores, 21% said club stores; and 15% said they shop at specialty food stores like Whole Foods and Trader Joe’s.

- Strong opinions on store brands offered

Responses to questions on how retailers can make SNAP store brands more appealing demonstrate there is opportunity to increase sales. When participants in the study were asked why they do not buy store brand products and instead buy national brand products with their benefits, 30% responded that store brand alternatives are not always available for SNAP purchase; 29% said they trust national brands more than their store and its brands; 25% reported there is not enough variety of store brands in their store; 23% said their family prefers national brands; 22% believe store brands are of lower quality than national brands,;19% have had an unsatisfactory experience with store brands; and 17% stated store brands are not as exciting or interesting as national brands.

- Respondents suggested ways stores can make store brands more appealing

Turning the question around, respondents were asked how their store can encourage them to buy more store brands. Some 42% wanted lower prices of store brand products; 38% said stores should ensure their store brands are available online using SNAP for home delivery or pickup; 36% said stores need to be sure their SNAP store brand products are always available; 34% would like a greater variety of SNAP store brand products; 33% said stores should offer more store brand alternatives for products they like to buy; 33% asked retailers to improve the quality of store brands; and 32% said they would like store brands in different package sizes.

- Online purchase of SNAP products is low, owing in part to the limited availability of remote ordering programs that accept benefits

When asked, how often do the survey participants currently use SNAP benefits to order food products online, the numbers were relatively small with 15% saying they always/almost always do so; 15% responded frequently; 20% said occasionally; 13% stated rarely; 27% reported they never do; and 11% asserted their stores do not offer a way to use benefits to order food products online. Provided with more digital resources, some promise for wider online ordering was expressed.

Fore more, the complete survey can be found here.