'Rightsizing' Store Count Can Benefit Retailers, Per Report

Foot traffic analytics firm Placer.ai has shared a new report detailing how several retailers are cutting down their number of stores to increase potential and efficiency.

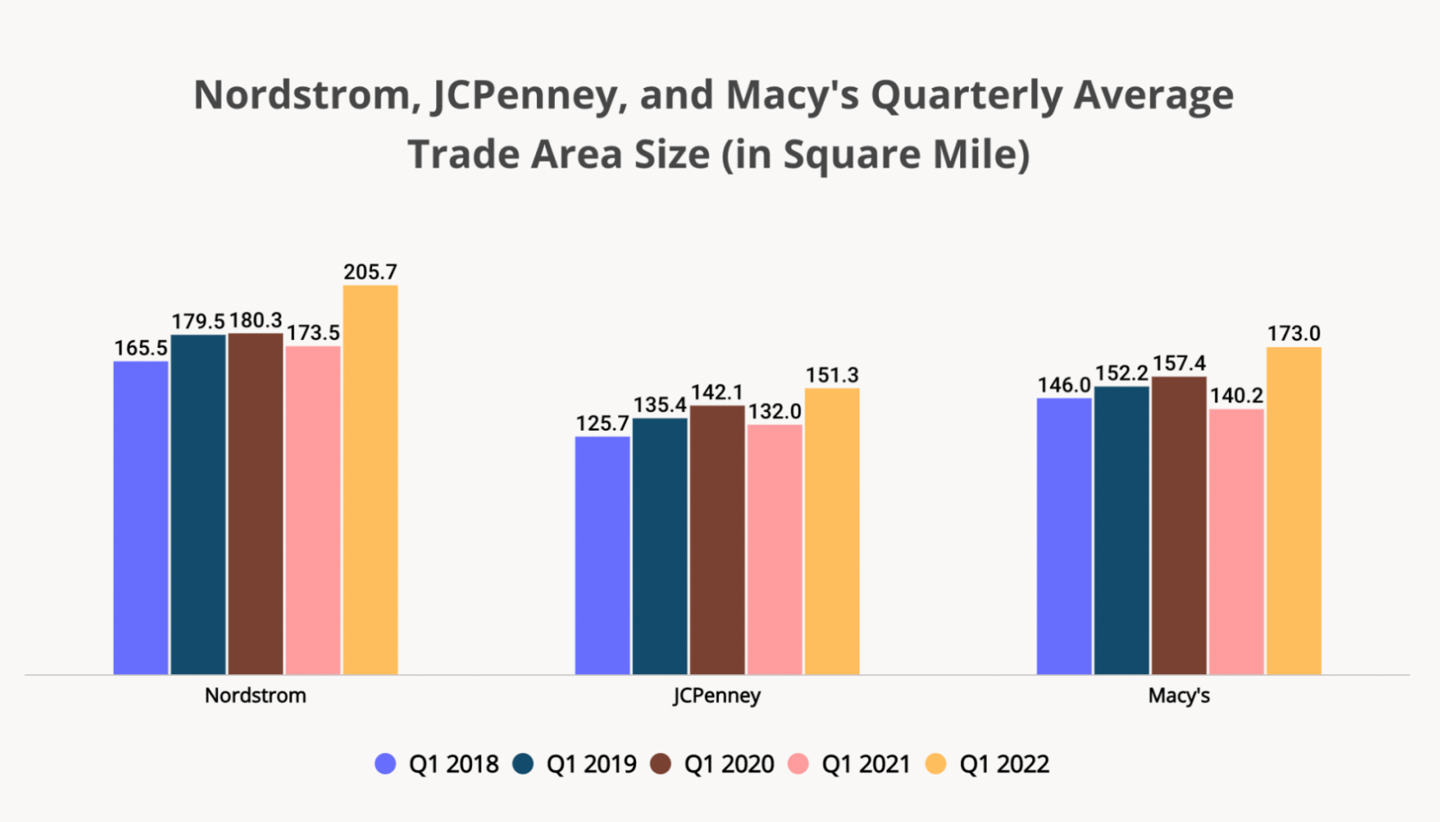

The report, “Brands That Are Rightsizing Right,” looked at store counts from Q1 2018 to Q2 2022, and found that closing stores can expand a retailer’s trade area size, combat ‘cannibalization’ between stores and allow for different store formats to better serve customers. Grocery and retail stores mentioned in the report include Macy’s, Nordstrom, JCPenney, Albertsons, Rite Aid and CVS, many of which are known for private brand assortments.

“Not all store closings are signs of a retail apocalypse. In fact, there is ample reason why the thinking about rightsizing needs to shift,” Placer.ai said in the report. Rightsizing has been classically seen as a softer terminology to discuss store closures. But there is a significant trend of rightsizing that is more focused on optimization. If a chain can reach the same audience with 80 stores that it can with 90, why not reduce the operational cost? If a brand can leverage a wider mix of store formats to better reach a specific market – this push can drive greater long term success. The process of rightsizing is about each retailer asking how to best deploy stores to accomplish its wider goals, and our interaction with the terminology needs to adapt accordingly.”

From 2019 to 2022, the three department stores included in the report all increased trade area size.

“These three department stores demonstrate that rightsizing can have significant benefits for improving store fleet efficiency,” the report said. “Many former growth strategies were centered around simplistic understandings of trade areas and demographic breakdowns, resulting in an overabundance of locations.”

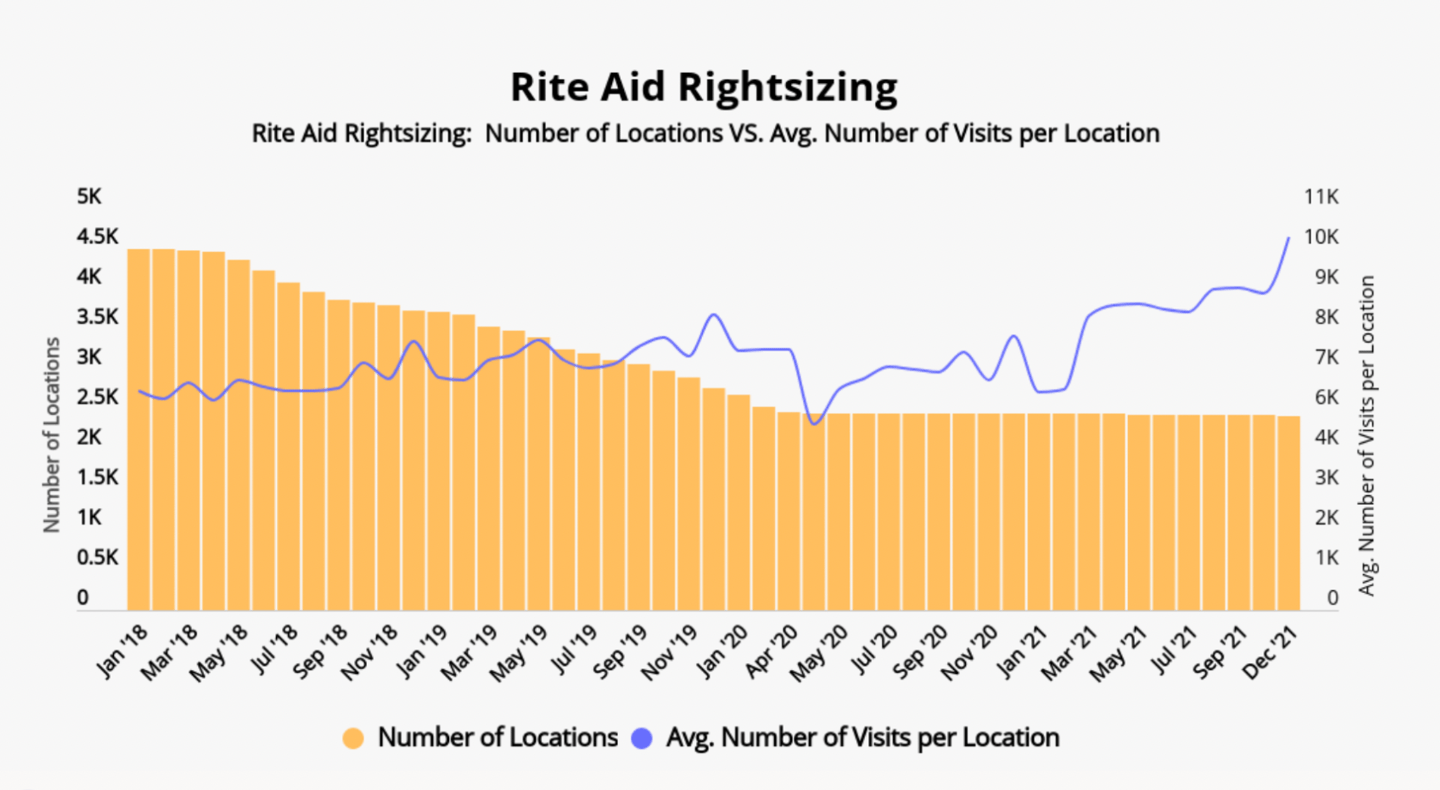

Placer.ai’s data also showed that Rite Aid’s location numbers have decreased significantly since 2018, but the average number of visits per location continues to rise.

“By December 2021, the company’s rightsizing was already bearing fruit – average visits per location were up by 70% as compared to January 2018,” said Placer.ai. “The brand plans to close an additional 145 stores by the end of 2022, expecting a $60M EBITDA benefit from the closures according to the company’s CFO.”

The full report from Placer.ai can be found here.