Numerator Breaks Down Who Is Shopping At Target

It’s been an interesting first three months of 2025 for Target.

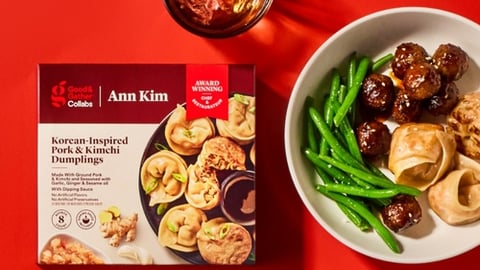

Following its fourth quarter and full-year sales figures that proved disappointing, the retailer immediately unveiled a growth plan that, among other things, included a sharper focus on expanding its assortment of private label products.

As the retail world closely watches Target’s progress into the second quarter, new data from Numerator is painting a picture of who shopped the Minneapolis, Minn.-based retailer in 2024.

More than three-quarters of U.S. households (78%) shopped at Target at least once this past year, with the average shopper spending $1,087. The customer repeat rate was 86%.

Based on income, 47% of Target shoppers are classified middle income ($40,000 - $125,000 annually), 32% are labeled higher income ($125,000 or more), and 21% are lower income (less than $40,000).

Most of Target’s shoppers live in urban or suburban areas (38% and 39% respectively) while 23% of those who shop the retailer live in rural areas. Additionally, 68% of Target shoppers own a home.

The insights from Numerator into the makeup of Target shoppers come just days after a report from YouGov revealed that Target is the second most popular destination for groceries among U.S. consumers, trailing only Walmart. Nearly two-thirds of the 22,000 respondents chose Walmart as their top destination for groceries, with Target second at 42.5%.

Across the four key generation groups (Gen Z, Millennials, Gen X, and Baby Boomers), Walmart and Target finished first and second.