Walmart The Top Grocery Destination For U.S. Shoppers

Walmart and Target are the two most popular destinations for groceries among U.S. consumers, according to a new report from YouGov, with Aldi and its broad selection of private label products ranking third.

In the U.S. Grocery Store Brand Rankings 2025, of the more than 22,000 respondents, nearly two-thirds chose Walmart as its top destination for groceries. Target was second at 42.5% and Aldi took the bronze medal as the top choice among 32.8% of respondents.

Across the four key generation groups (Gen Z, Millennials, Gen X, and Baby Boomer), Walmart and Target finished first and second. The noteworthy differences among the generations was that Gen Z and Millennials each selected Costco as their third favorite, with Aldi the third choice among Gen X and Baby Boomers.

“In today’s challenging economic climate, where rising living costs continue to put pressure on household budgets, consumers are making more considered choices about where they shop,” said Kenton Barello, vice president of YouGov America. “Grocery stores are at the heart of this daily decision-making, balancing affordability, quality, and service to meet evolving customer expectations.”

High grocery prices in the post-pandemic world have led consumers to sharpen their focus on making their budgets go farther. When looking for the best value, survey respondents ranked, in order, Walmart, Aldi, Costco, Target and Sam’s Club as their Top-5 choices. When product quality is top of mind, shoppers selected Whole Foods Market as their top choice, with Target, Trader Joe’s, Costco, and Aldi rounding out the Top-5.

The inclusion of Target, Costco, and Aldi on both lists comes at a time when the three retailers have discussed a need to boost the value of their products, with each putting greater focus on their respective private label assortments.

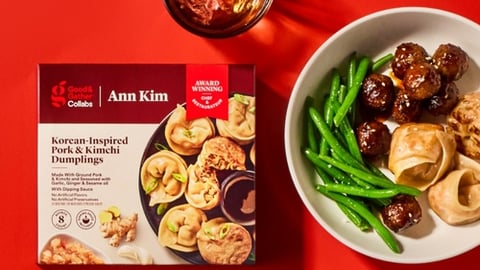

Target’s more than 40 own brands accounted for $31 billion in sales in 2024, and the retailer this year has discussed its efforts to further expand its private label product assortment. This year, Target’s Good & Gather and Favorite Day own brands combined will see more than 600 new items.

Costco’s Kirkland Signature own brand currently has a penetration rate of 33%, and the assortment of products under the brand is growing. Ron Vachris, Costco’s CEO, said during a December conference call that products sold under Kirkland Signature were growing “a little faster” than the rest of its business.

Aldi’s popularity with shoppers could grow further this year as the grocer continues its aggressive expansion efforts across the U.S. The Batavia, Ill.-based company recently announced plans to open 225 new stores in 2025. This growth will put Aldi’s broad selection of own brand products in front of a larger number of consumers.

Online grocery shopping also continues to grow, but retailers remain challenged to fully understand the digital shopping habits of its customers. Nearly two-thirds of respondents in the YouGov survey said they ordered groceries online from Walmart in the past 90 days. Amazon (34%) was second with Target, Kroger, and Sam’s Club a distant third, fourth, and fifth.

What factors would make online grocery shopping more palatable? Survey respondents said notifications of product availability (42%), a product comparison function (28%), product search and filters (24%), more in-depth product information (23%), and reviews from buyers (21%) would each help enhance the experience.