IRI predicts growth for store brands during inflationary 2022

In 2022, store brands, value channels and value retailers are expected to gain market share as consumers seek value in an inflationary environment, according to a new report from market research company IRI.

The firm has released its 2021 "CPG Market Review and 2022 Outlook" report, giving insight on the grocery and retail markets from the past year and projecting what’s to come in 2022. Krishnakumar Davey, president of strategic analytics at IRI, sat down with Store Brands recently to discuss how private brands can benefit from current inflation. IRI data recently showed how some products had been affected by shortages and inflation ahead of the holiday season, leading to an advantage for private label competitors.

In the outlook report, IRI reported that in 2021 there was a steady acceleration of purchases around premium products would could've caused a dip in store brand market share but opens an opportunity for more premium private brand products. The report saw private brand market share decline from 19% pre-pandemic to 18.3% the latest 12 weeks ending Oct. 31.

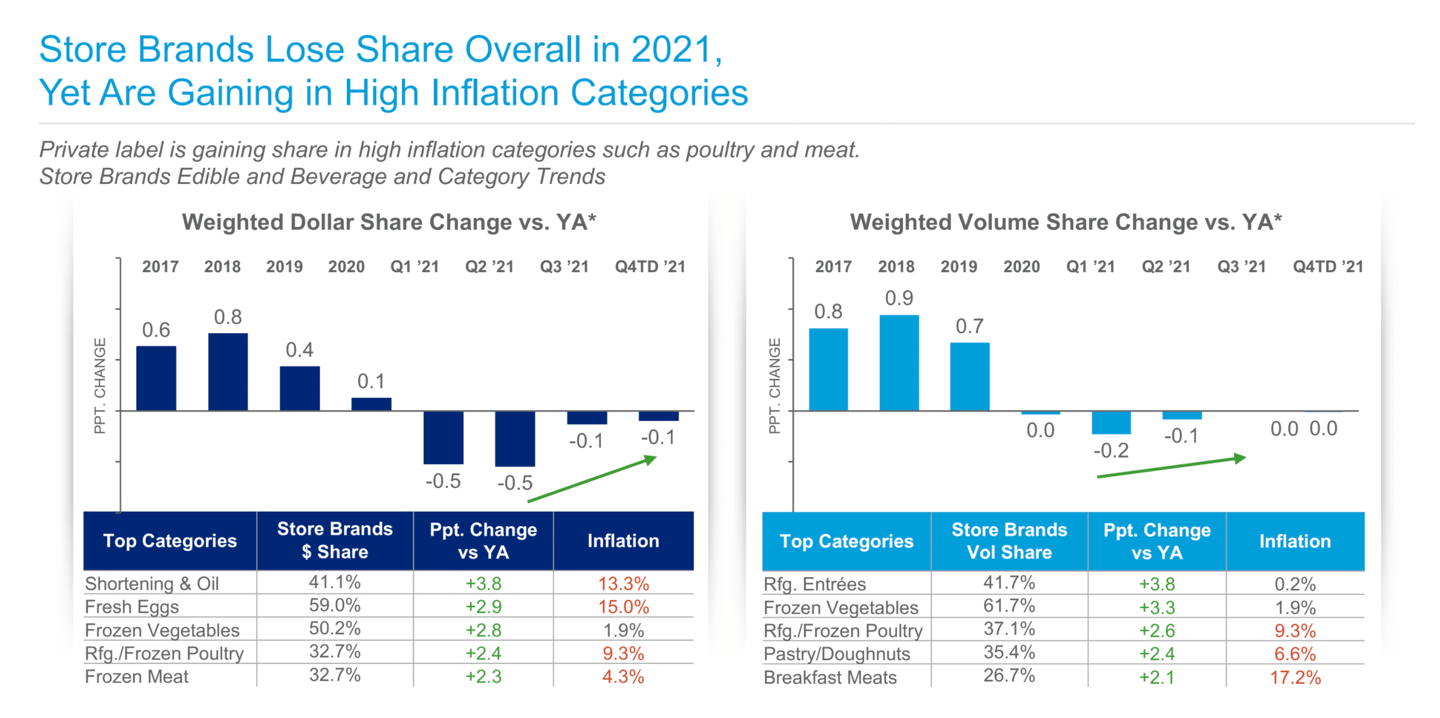

The report also shows private brands gaining in high-inflation categories such as poultry and meat and frozen foods. Store brand refrigerated entrees gained nearly 4% volume share compared with a year ago, and frozen vegetables, frozen poultry, pastries and breakfast meals all gain in volume share between 2-3%.

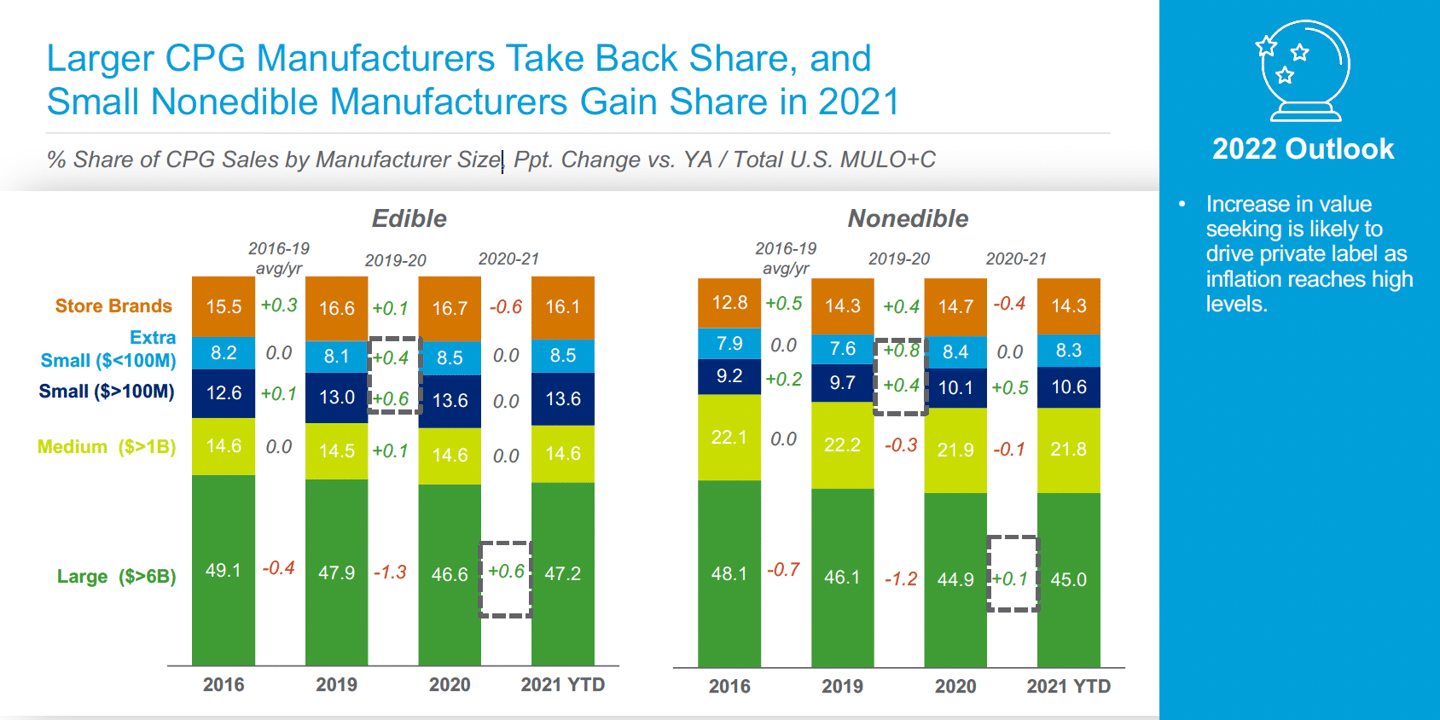

In market share among store brands and various CPGs from larger companies to medium-sized and smaller national brands, store brands lost its share of sales by less than a point in 2021. The report showed store brands had a 16.1% share of CPG sales, down from 16.7% in 2020 and a 14.3% share in nonfoods, down from 14.7% a year ago. Both those numbers are higher than a few years ago.

Among other key 2021 trends, at-home CPG consumption remained strong compared to pre-pandemic levels. Away-from-home consumption improved with mobility, yet remains below 2019 levels. Price/mix rose steadily throughout 2021, initially due to mix shifts and reduced deals; and by year end, due to larger everyday price increases. In edible, price/mix increases offset slight volume/unit declines vs. 2020.

IRI reports that many large companies announced additional price increases to account for increases in commodity, production, packaging, transportation and labor costs in 2021 and as a result, the largest $1 billion or more brands outperformed in 2021. Leading brands retained more penetration gains from COVID-19. IRI saw evidence of increasing price sensitivity, notably where price increases are significant, such as in meat categories.

Low-income consumers and younger cohorts continued to drive growth in CPG, due in part to remote and hybrid work and suburban living. The club channel continued to grow sales and buyers, but grocery lost share as shoppers returned to stores and mass channel regained traction.

As for IRI’s 2022 predictions, in addition to store brands gaining market share, the firm said that price will drive growth in 2022, as increasing mobility and inflation puts downward pressure on at-home consumption volume. IRI said to look for balanced growth across price tiers, including mainstream and value tiers.

To gain unit and volume share, CPGs and retailers will promote more often, and pre-COVID-19 price cuts discount levels will take a while to return. Away-from-home and on-the-go consumption will continue to increase, and trends of convenience, particularly around meal solutions, will continue. Demand for on-the-go options will increase, and self-care and home care will remain priorities.