Inflation continues to grow private label, per study

Continued inflation is driving private label growth, according to a new study from DataWeave. The report, titled Inflation Accelerates Private Label Share and Penetration, looks at top private label brand penetration, ranks brands by category, and tracks price variations across regions, along with private label ratings, reviews and ranks.

DataWeave, a retail analytics firm, found that on average, retailers in the U.S. carried more than 4,500 private label products online and had private label brand penetration of more than 13%, with the category expected to grow with no signs of inflation slowing down. The Private Label Manufacturers Association recently reported that private label sales hit a record $199 billion in 2021, a 1% increase from 2020.

“Across the ten major grocery retail chains we analyzed, private label brands were more economical compared to national brands, which is likely one of the key factors contributing to the private label’s increased penetration across grocery categories,” said DataWeave CEO Karthik Bettadapura. “We will continue to watch private label closely, as it seems to be impacting many decisions across the retail value chain, from margins to merchandising.”

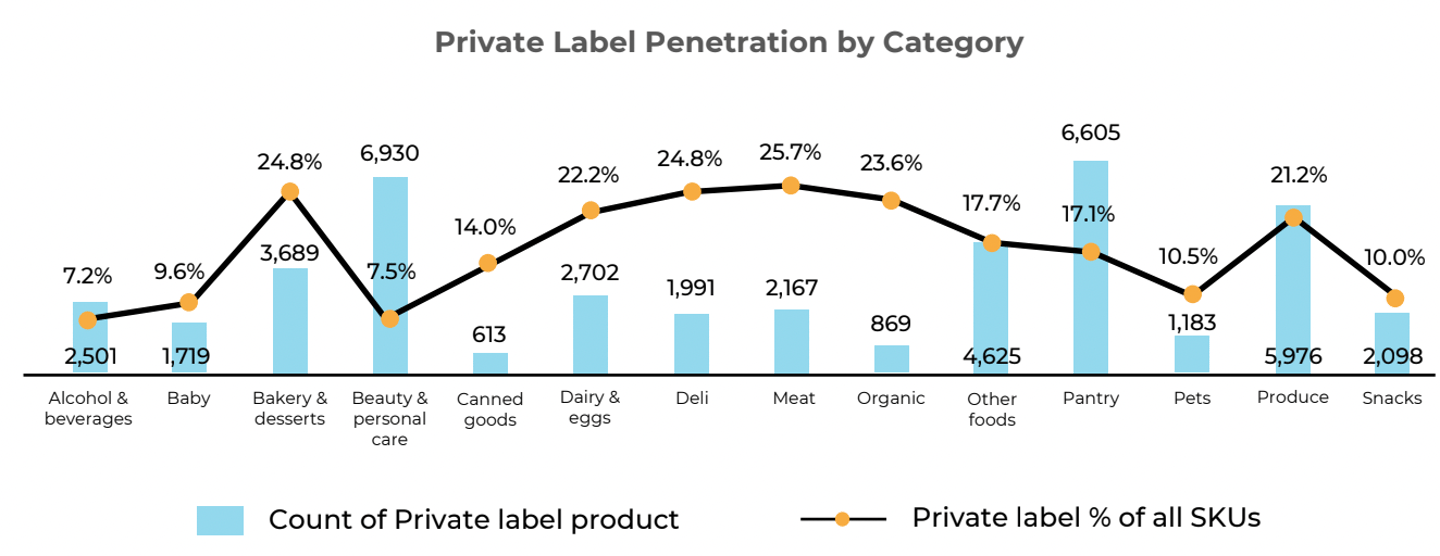

According to the report, grocery categories with the highest inflation saw the most private label penetration. Private label brands also gained volume share in high-inflation food categories such as poultry, meat and frozen foods in 2021. While the total SKU count is much smaller as an overall category, meat had the highest share of private label brands (25%) within the analysis. The presence of private label products was the lowest in alcohol & beverages (7.2%) and beauty & personal care (7.5%) categories, indicating a strong preference for national brands.

“Availability and affordability amid prolonged economic uncertainty furthered the power and presence of private label brands in 2021, increasing market penetration beyond all expectation,” said Krishnan Thyagarajan, president and COO of DataWeave. “Our data found that eight of the top ten brands with the highest number of SKUs carried across all grocery retailer websites in our analysis were private label goods, signaling the strength of their share of voice and verifying a shift in consumer preferences.”

Eight of the top ten brands with the highest SKU count within DataWeave’s analysis were private label brands. Publix brand and Signature at Safeway had the highest share of total private label SKUs with 86% and 85% percent respectively, while brands like Great Value and Threshold have a much smaller overall share at 33% and 23% percent respectively. Yet, the two made up 56% of the total private label grocery SKUs on Walmart.com.

The report also showed that in 2021, private label brand penetration was approximately 18% across grocery categories, both online and in-store. Of the retailers studied, Target and Whole Foods Market had private label brand penetration of more than 20 percent. Target had the highest number of private label SKUs (13,220), followed by Walmart Grocery (10,673), Kroger (7,743), and H-E-B (7,348).

The full report can be found here.