New Report Spotlights Growth of Grocery E-commerce

More than 90% of grocery shoppers are visiting stores and using online tools to complete their weekly shopping trips, according to a new report from FMI—The Food Industry Association and NielsenIQ (NIQ).

Eight years ago, the two organizations forecast that digitally engaged grocery shopper spending would reach $100 million or 20% market penetration. The new report reveals those projections were exceeded, with FMI and NIQ projecting total U.S. online grocery sales to reach $388 billion, or 25% market penetration, by 2027.

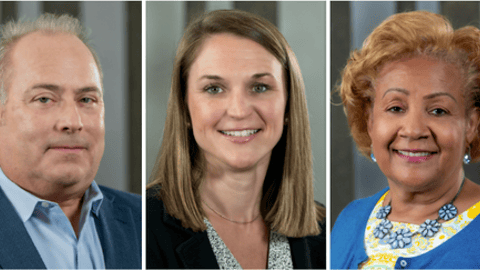

“Consumers are seamlessly blending in-store and online experiences to meet their needs,” said Mark Baum, chief collaboration officer and senior vice president of Industry Relations for FMI. “Our research underscores the urgency for food retailers and manufacturers to adapt to this omnichannel reality and leverage digital technologies to enhance convenience, personalization, and trust. Trading partners need to meet consumers where and how they want to be met.”

“Digital engagement is no longer a complementary strategy, it’s essential to growth,” said Kim Cox, managing director of Omnicommerce at NielsenIQ “With online food sales projected to reach $388 billion by 2027, retailers and manufacturers must prioritize e-commerce and social commerce strategies to meet the expectations of digitally connected consumers.”

Other key findings of the report include:

- Online Sales Growth: Online sales growth exceeds that of in-store for food and nonfood categories, while in-store leads in total share.

- Youth Purchasing Power: Gen-Z begins its shopping journeys online and is heavily influenced by social media. Meanwhile, Millennials index the highest for online purchasing.

- Social Media E-commerce: 55% of respondents now make direct purchases from social media or live-stream platforms for grocery and household items.

- Technology Prioritization: 92% percent of retailers are using technology, including AI, to personalize or customize shopping or marketing experiences, both online and in-store.

- Curbside Pickup: Curbside pickup is used more often by shoppers at 31% of respondents, overtaking same-day home delivery, which has dropped to 29%.

Officials with FMI and NIQ said the findings highlight the challenges and opportunities facing food retailers and manufacturers to prioritize their connected commerce strategies. Embracing channel fluidity, which allows shoppers to move effortlessly between e-commerce, in-store, and social channels, is essential for future success.